Verdict:

• Short-run Neutral.

Macro:

• US September CPI up 3.7% on the year, est. 3.6%, last 3.7%. September CPI up 0.4% on the year, est. 0.3%, last 0.6%. The jobless claims in US last week reached 209,000, est. 210,000, last 207,000.

• Opec monthly report increased global economy in 2023 to 2.8%, maintain the growth rate at 2.6% for 2024. OPEC maintained the crude oil demand growth at 2.44 million barrels/day in 2023, and 2.25 million barrels in 2024.

Iron Ore Key Indicators:

• Platts62 $118.20, +1.95, MTD $118.13. The fundamental outlook gradually recovered on the iron ore, given a still weak steel margin. The market supported by the export list control discussion in Australia currently, while some market participants linked the news with iron ore and coals. No further update on the details of the list from then on. The mid grade and low grade iron ores were currently both popular because of recovering stocking activities of China mills back from long holiday.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 12th)

• Futures 122,216,500 tons(Increase 1,919,400 tons)

• Options 113,679,400 tons(Increase 2,104,700 tons)

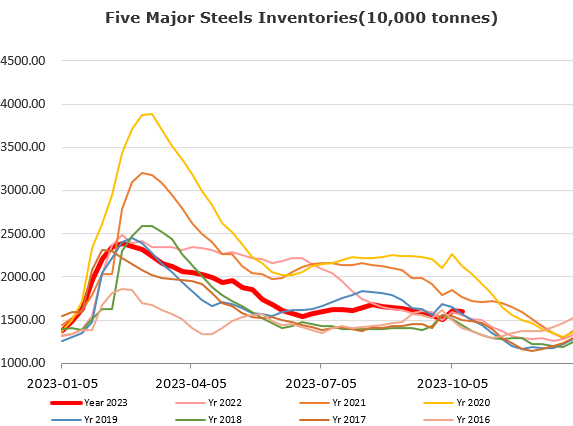

Steel Key Indicators:

• CISA statistic indicated that the member steel mills total produced 20.83 million tons of crude steel in late October, or 2.083 million tons per day, up 0.81% from mid-October.

Coal Indicators:

• The spread between end-user and traders were widen in Australia FOB market. Indian buyers were trying to negotiate based on a price level lower than Index, while sellers were looking at much higher level. There were market participants believed that as the increasing supply in November for prime coals, the price potentially see resistance for November delivery in next few weeks.