Verdict:

• Short-run Neutral.

Macro:

• ECB banker Christian Lagarde said that the disappear on base effect will naturally control inflation from increasing in mid-run. Thus, the further interest hike potentially become avoidable.

• China Ministry of Housing and Urban Rural Development stated that the new housing strategies in China had taken effect. From January to October, the overall number of new home buyers and second-hand houses trade increased on the year. During the same time, house completion area up 20% on the year.

Iron Ore Key Indicators:

• Platts62 $129.80, +1.65, MTD $127.20. Seaborne market was slight quiet during past week compared to the first week in November. PBF demand was shifted to low grade because of the continuously weakened steel margin. Lump premium started to strengthen as the expectation on winter production curb.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 10th)

• Futures 129,681,200 tons(Increase 1,921,300 tons)

• Options 104,693,300 tons(Increase 445,000 tons)

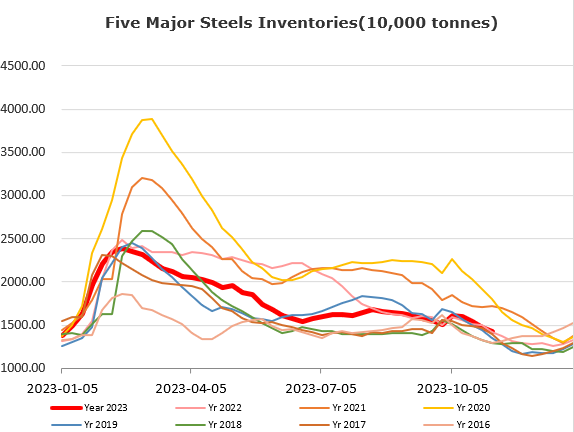

Steel Key Indicators:

• The biggest China steel maker, Baowu Group increased HRC and galvanized steel price by 100 yuan/ton for cargoes delivered in December based on November settlement.

Coal Indicators:

• The weather forecast indicated that the Australia rainy season would become drier and with less disruption on delivery. On the other hand, China and north Asia entered winter. Market participants expected production cut in China.

• FOB market was dragged down again by lower trade on PMV at $296.5/mt for early December delivery.