Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• S&P 500 have created the biggest single week growth in percentage since February 5th, 2021. Market recovered sentiments and inflation statistic fell in expectation range.

• China political conference during weekends revealed positive signals on stablising infrastructure demand, which stimulate the industrial commodities pushing this morning.

• China issued specilised debts in 219 million yuan earlier than expected.

Iron Ore Key Indicators:

• Platts 62%: $102.60, -4.10, MTD $102.94. Steel mills were conservative on the production schedules, which created a bottleneck on marginal demand for iron ores. Both seaborne and domestic market were light. However China political conference mentioned a stablised growth on infrastructure, which were slight over-expected to investors. Thus iron ore and other ferrous products were bought higher by the beginning of the Monday.

• China Metallurgical News indicated that pig iron production expected to decrease 62 million tonnes(7.2%) in the year 2022, approximately equal to 100 million tonnes decrease on iron ore demand.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 10th)

• Futures 82,939,000 tonnes(Increase 947,300 tonnes)

• Options 56,894,000 tonnes(Increase 885,000 tonnes)

Steel Key Indicators

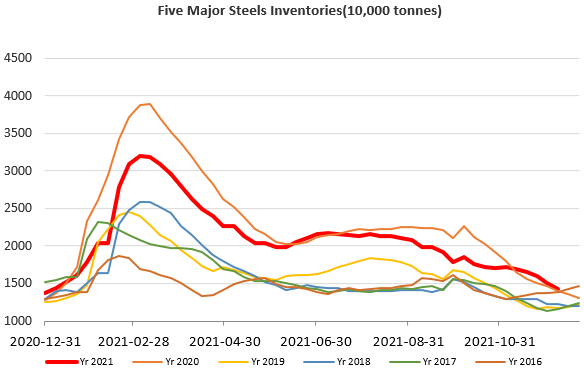

• Steelbank construction steels inventory 3.63 million tonnes, down 5.15% w-o-w. HRC inventories 1.85 million tonnes, down 6.11% w-o-w.

• China 71 EAFs average operation rate at 48.88%, up 0.33% y-o-y last week.

Coal Indicators

• Hebei province strictly control the new capacity increase on steel and coking industries during the next three years.

• Mongolia ports cleared 100 coal trucks daily during last week, which was far behind scheduled 600- 700 trucks daily, because the increased risk of pandemic.