Market Verdict on Iron Ore:

• Neutral.

Macro:

• EU planned to impose import tariffs on carbon emissions on steels, cements and polluted commodities, to support the European industries.

• China PBOC(central bank): November social financing 1.99 trillion yuan, down 610.9 billion yuan on the year. M2 money supply remains at 264.7 trillion yuan, up 12.4%, refreshed the fastest year-on-year growth since April 2016.

Iron Ore Key Indicators:

• Platts62 $110.25, -2.15, MTD $108.81. China traders indicated expecting no more curbs in winter, to catch up building and manufacturing impacted by pandemic during most time of the year. India fines were active in Asia, with 22-23% discount at IODEX January Index, which potentially generate pressure to FMG or other low grade market. The winter cut in China was generally smaller compared to previous years, lump premium dropped from 0.1485dmtu from the beginning of December to 0.13dmtu. Chinese concentrates supply expected to increase as the loosening of pandemic control and normalisation of transportation.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 12th)

• Futures 99,966,000 tons(Increase 982,200 tons)

• Options 82,435,300 tons(Increase 375,000 tons)

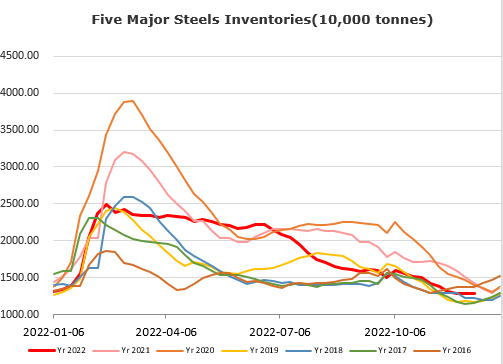

Steel Key Indicators:

• Tangshan average billet cost 3751 yuan/ton, up 47 yuan/ton on the week, average loss at 121 yuan/ton.

Coal Indicators:

• Australia FOB marketmaintained strong at $249-250, supported by the wet weather impact on eastern Australia PMV supply. There was HCCA Unbranded Prime offer at $255 from last week, however failed to entice bids.