Market Verdict on Iron Ore:

• Neutral to bearish.

Macro

• Experiencing the significant price increase on thermal coal and iron ore, China Disipline Inspection Comission urged the committee of the CSRC and DCE to earnestly fulfill their supervision responsibilities and potential risks of the commodity futures market, improving internal governance and effectively maintain the normal operation of the futures market.

• U.S. CPI in March up 8.5% y-o-y, created the highest since the year 1981, however core CPI was lower than expectation. The new Vice Chairman of the Fed Brainard indicated that the U.S. Fed would initiate fast actions to increase the interest rate to neutral level and potentially decide to unwind the balance sheet in this May.

• OPEC indicated would not change production policy since the war has impact on both supply and demand. U.S. EIA decreased the oil production growth rate in the year 2022 and the year 2023.

Iron Ore Key Indicators:

• Platts62 $154.85, +4.25, MTD $157.10. Seaborne liquidity continue to remain thin. PBF has none bid at all even physical traders try to lower the offer, since bids were testing the affordability of offers on seaborne cargoes. MACF inventories improved significantly on northern ports, still markets were very willing to buy both on ports as well as fixed price from seaborne market. Spreads between 65 and 62 narrowed by 50 cents and market expect the spread continue to narrow in the next few weeks due to the cost saving strategy from steel mills.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 12th)

• Futures79,758,900 tonnes(Increase 218,200 tonnes)

• Options 82,686,000 tonnes(Increase 27,000 tonnes)

Steel Key Indicators

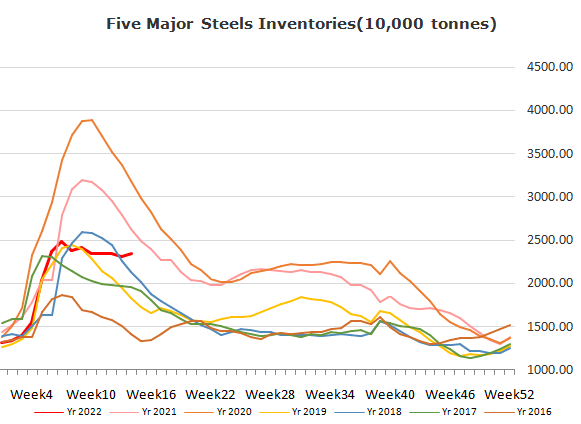

• Steelbank construction steel 8.13 million tonnes, down 2.38% w-o-w. HRC 3.02 million tonnes, up 3.05% w-o-w.

Coal Indicators

• Indian Coal Department announced that the India production of coal would increase by 65% at 140 million tons in the FY 2022.