Market Verdict on Iron Ore:

• Neutral to bearish.

Macro:

• EU increase the growth rate of economy from 0.3% to 0.9%. At the same time, EU decreased the inflation expectation from 6.1% to 5.6% in 2023. EU indicated that Euro potentially had escaped technical recession.

Iron Ore Key Indicators:

• Platts62 $121.85, -4.25, MTD $124.47. Market participants believed that the recovery of pig iron was slower than expected, which created marginal bearish outlook on the short-run dynamics. The continuous rebound on iron ore index and the low premium in PBF and NMHG lured the traders’ interest on premium cargoes. The low MB65- P62 was due to low steel mills margin, given a tight supply of Brazil iron ores. Recently BHP sold few laycans of JMBF at IODEX March Index and a discount of $4.9. PBF and NHGF premium have pressure on float basis. The import loss caused by sudden increased iron ore could hold back the physical traders interest again.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 13th)

• Futures 104,889,600 tons(Increase 820,700 tons)

• Options 80,024,300 tons(Increase 545,000 tons)

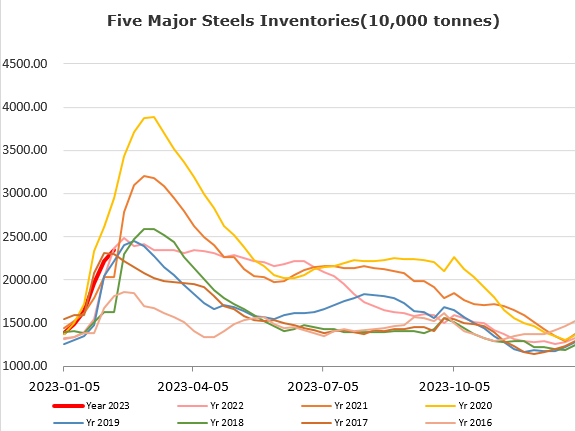

Steel Key Indicators:

• The three biggest steel mills in eastern Turkey, Bastug Metalurji、Tosyali Demir Celik, Ekinciler Holding, announced Force Majeur in February 10th.

Coal Indicators:

• The FOB Australia coking coal market maintained stable, while HCCA Branded bids grew for several days at $390/mt due to supply tightness. The tradeable range for PMV normalised by PLV was $370-385.