Market Verdict on Iron Ore:

• Neutral.

Macro

• U.S. CPI refreshed 40 -year-high at 9.1%, last 8.6%, est. 8.8%. However U.S. president Joseph Biden believed that the oil price has fallen recently, which yet to reflect in the inflation statistics.

• Goldman Sachs expected copper average price at $6700/mt, $7600/mt and $9000/mt in the coming three months, six months and twelve months respectively. Last estimation at $8650/mt, $10500/mt and $12000/mt

• Liquidity in China’s interbank market is more than “reasonably ample,” the head of the central bank’s monetary policy department said Wednesday, an indication that further rate cuts are unlikely.

Iron Ore Key Indicators:

• Platts62 $109.40, +3.60, MTD $112.14. Chinese steel mills expected that margin could recover with initiative control on production in June and July. Thus, Chinese blast furnace utilisation rate drop by more than 3% in June on the month. Seaborne float premium on PBF maintained around $0.55 to $0.65 on MOC platform over the last two months, however lack of buying interested on float basis cargoes. Newman fines saw discount first time in the year. However seaborne trades through float basis were light in general. JMBF cargoes saw ample interests and trades, discount improved from $8.7-8.9 to $8.3.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 13th)

• Futures 91,270,300 tons(Increase 4,918,300 tons)

• Options 81,500,500 tons(Increase 1,030,000 tons)

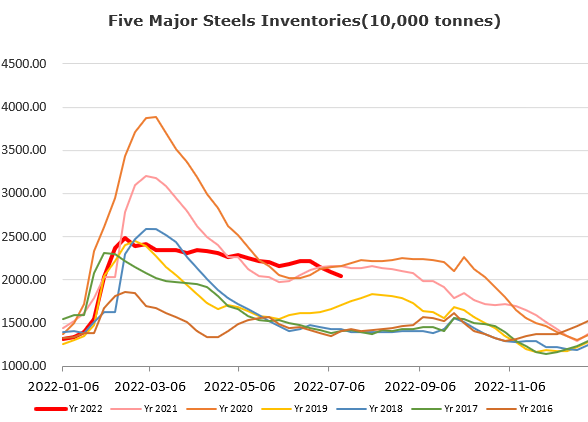

Steel Key Indicators

• Tangshan average billet cost 4030 yuan/ton, down 131 yuan/ton on the week, average loss at 382 yuan/ton.

Coal Indicators

• Australia PLV market saw an HCCA Unbranded PLV traded at $238. Market saw ample buyers to confirm this level as the periodic bottom.