Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. September CPI up 8.2% y-o-y, est. 8.1%, last 8.3%. U.S. CPI up 0.4% m-o-m, est. 0.2%, last 0.1%.

• China NBS: September CPI up 2.8%, refreshed high of the year, last 2.5%, est. 2.8%. China PPI September up 0.9%, est. 1.0%, last 2.3%.

Iron Ore Key Indicators:

• Platts62 $94.2, -2.3, MTD $96.07. The trade activity significantly improved after Chinese golden weeks. JMBF discount narrowed from $4.5 to $2.9 across holiday. PBF premium improved from 0 to $2 during same period. BRBF and Brazil mid-grade maintain popularities, however the decreased alumina premiums indicated a slight oversupply on the relevant cargoes on seaborne market. Nov- Dec 23 spread in SGX increased from $0.35 to $1.55 during the previous 5 weeks, with limited growth on the outright side. The fast expansion of the spread potentially was due to the demand market difference on early Q4 and late half of Q4 in China. The continuous production cut and incoming environment protection actions before important national congress in China boosted the lump premium from $0.1 dmtu in mid-September to $0.2475 dmtu early this week. Market participants believed a follow-up growth as the physical supply was still tight at the current 2-3 weeks.

• MySteel 45 ports iron ore inventories at 129.93 million tons, up 308,500 tons w-o-w. Daily evacuation 3.14 million tons, up 92,300 tons w-o-w. Australia iron ore 58.13 million tons, down 757,400 tons w-o-w. Brazil iron ore 46.41 million tons, up 837,300 tons w-o-w. 91 ships at ports, unchanged.SGX Iron Ore 62% Futures& Options Open Interest (Oct 13th)

• Futures 94,550,600 tons(Increase 2,031,400 tons)

• Options 78,401,900 tons(Increase 6,918,400tons)

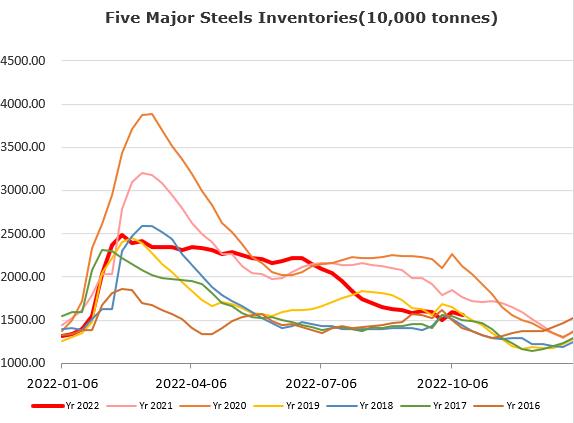

Steel Key Indicators:

• Mysteel researched 247 blast furnace operation rate at 82.62%, down 0.88% w-o-w. Utilisation rate 89.04%, up 0.06% w-o-w. Daily pig iron production 2.4015 million tonnes, up 2,100 tonnes.

Coal Indicators:

• FOB Australia coking coal maintained at $283.5 based on the PLV trade reported done at $285 for 35,000mt cargoes from globalCOAL, no fresh trade was finished after then. The market was waiting for the Chinese pandemic relief and conference. Current market was supported by the wet condition in Australia as well as tight supply on laycans.