Verdict:

• Short-run Neutral.

Macro:

• China M2 supply up 10.3% in October, the growth rate was flat to last month, however 1.5% lower than last October. Social finance amount reached 1.85 trillion yuan, up 910.8 billion yuan on the year, or 9.3%.

• The economists from Goldman Sachs expected that the US federal would not cut interest rates until the fourth quarter of 2024. The soft-landing of US economy had made substantial progress.

Iron Ore Key Indicators:

• There was no index because of Singapore holiday. Thus, no seaborne trade reported. Seaborne market was slight quiet during past week compared to the first week in November. PBF demand was shifted to low grade because of the continuously weakened steel margin. Lump premium started to strengthen as the expectation on winter production curb.

• MySteel Australia and Brazil total delivered 21.409 million tons of iron ore, down 4.109 million tons on the week. China 45 ports iron ore arrivals at 20.515 million tons, down 5.417 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 13th)

• Futures 130,862,700 tons(Increase 1,181,500 tons)

• Options 105,082,300 tons(Increase 389,000 tons)

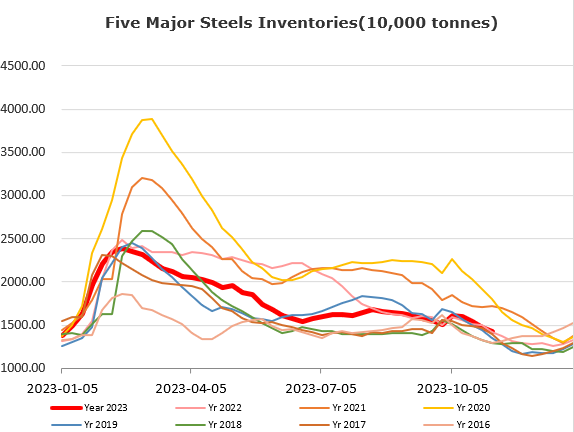

Steel Key Indicators:

• Steel sales shift from northern China to southern China because of the entrance of winter in the north with significant decrease on temperature.

Coal Indicators:

• The cokery plants proposed 100-110 yuan/ton increase on physical coke in North-western China, considering the winter stock from steel mills.