Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. CPI up 0.1% in November on the month, estimated up 0.3%, last 0.4%. November CPI up 7.1% on the year, created the smallest single month increase since December 2021, est. 7.3%, last 7.7%. November PCE up 6% on the year, est. 6.1%, last 6.3%.

• China Economic Blue Book predicted that consumer price maintain stable growth in 2023, expected 2.8% growth in CPI and 1.2% growth in 1.2%.

Iron Ore Key Indicators:

• Platts62 $110.30, +0.05, MTD $108.98. The physical trades fell into seaborne mid-grade again during early half of this week. PBF was traded in fixed price a t $110.15. JMBF was traded at a $5.6 discount based on January average. China traders indicated expecting no more curbs in winter, to catch up building and manufacturing impacted by pandemic during most time of the year. India fines were active in Asia, with 22-23% discount at IODEX January Index, which potentially generate pressure to FMG or other low grade market. Chinese concentrates supply expected to increase as the loosening of pandemic control and normalisation of transportation.

SGX Iron Ore 62% Futures& Options Open Interest (Dec13th)

• Futures 101,804,800 tons(Increase 1,838,800 tons)

• Options 82,882,800 tons(Increase 447,500 tons)

Steel Key Indicators:

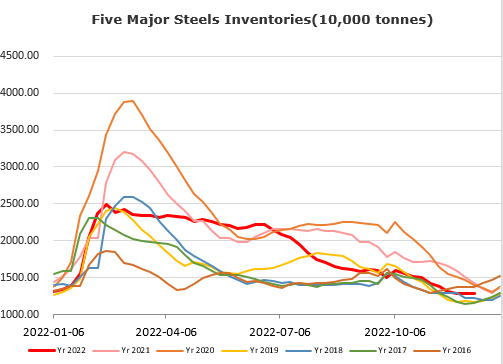

• Chinese winter stock for steels in downstream and physical traders were in general smaller compared to last year. The tradeable range for rebar was around 3600-3700 yuan/ton.

Coal Indicators:

• Australia FOB marketmaintained strong at $249-250, supported by the wet weather impact on eastern Australia PMV supply. There was HCCA Unbranded Prime offer at $255 from last week, however failed to entice bids.