Market Verdict on Iron Ore:

· Neutral to bearish.

Macro

· As the Chinese domestic financial data in February exceeded expectations, the further monetary ease was expected in the near future.

· A member of the Russian delegation to the Russia Ukraine negotiations, said that “substantial progress” had been made in the negotiations with Ukraine. Russia and Ukraine confirmed that the fourth round of talks will be held by video on Monday, March 14.

· This week, the U.S. Federal Reserve will lead the global central bank super week. Federal Reserve and the Bank of England are both expected to raise interest rates by 25 basis points, the Central Bank of Brazil is expected to raise interest rates by 100 basis points, and the central banks of Turkey and Japan may maintain current interest rate.

Iron Ore Key Indicators:

· Platts62 $154.50, -1.85, MTD $154.25. The spread between onshore ports and seaborne maintain wide, seaborne corrected as the thin buying interests last week. The major seaborne trades were concentrated in the heavy discount iron ores, for example MACF, JMBF or Yandi Fines. As Chinese steel margin narrows, SP10 fines and SSF are also becoming popular on ports. Ukraine miners were running at only 50% utilization rate. Pellets export to China has been disrupted, however Chinese mills are more reliable on domestic pellets since domestic miners recovered to normal production. Chinese mills also concerning the Ukraine pellets had become less cost-effective as well as laycans deterred.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 11th)

· Futures 87,797,000 tonnes(Increase 1,917,600 tonnes)

· Options 83,566,300 tonnes(Increase 608,000 tonnes)

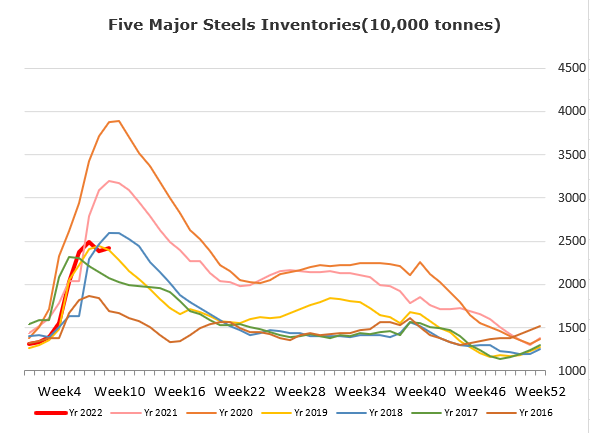

Steel Key Indicators

· China Tangshan average billet cost 4494 yuan/ton, up 149 yuan/ton w-o-w. Average steel profit 266 yuan/ton.

· U.S.CMC, SDI, NUCOR increased ex-factory rebar price from $40-100/st last week.

Coal Indicators

· China coke plants are planning to increase offer for the fourth rounds by 100 yuan/ton.