Market Verdict on Iron Ore:

• Neutral.

Macro

• China PM Li Keqiang presided over the executive meeting of the State Council, made timely use of monetary policy tools such as RRR reduction, further strengthened financial support for the real economy, especially industries seriously affected by the epidemic, small, medium-sized and micro enterprises and individual industrial and commercial households, reasonably transferred profits to the real economy and reduced comprehensive financing costs.

• U.S. Federal official Waller indicated that the Fed potentially start to increase interest rate by 50 points in May because the inflation rate expected to reach a roof area.

Iron Ore Key Indicators:

• Platts62 $151.40, -3.45, MTD $156.47. Seaborne liquidity continue to remain thin. PBF has none bid at all even physical traders try to lower the offer, since bids were testing the affordability of offers on seaborne cargoes. MACF inventories improved significantly on northern ports, still markets were very willing to buy both on ports as well as fixed price from seaborne market. Spreads between 65 and 62 narrowed by 50 cents and market expect the spread continue to narrow in the next few weeks due to the cost saving strategy from steel mills.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 13th)

• Futures 80,362,500 tonnes(Increase 603,600 tonnes)

• Options 82,863,500 tonnes(Increase 177,500 tonnes)

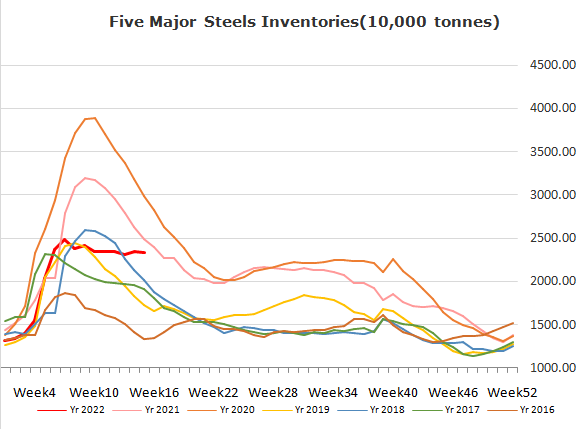

Steel Key Indicators

• In early April, CISA statistic indicated that major steel enterprises produced 2.22 million tons of crude steel per day, up 2.96% from late March. Pig iron daily production reached 1.96 million tons, up 5.65% from late March.

• MySteel Rebar Inventory: Rebar production 3.07 million tonnes, down 0.8% w-o-w. Mills inventory 3.4 million tonnes, up 7.13% w-o-w. Circulation inventory 9.42 million tonnes, down 2.8% w-o-w.

Coal Indicators

• Indian Coal Department announced that the India production of coal would increase by 65% at 140 million tons in the FY 2022.