Market Verdict on Iron Ore:

• Neutral.

Macro:

• EU published winter report in 2023, increased the economic growth rates of EU and Euro Zone to 0.8% and 0.9%.

• U.S. January CPI fell from 6.5% to 6.4%, created a 7-month drop, refreshed new low since October 2021, however higher than expected 6.2%. Core CPI up 5.6%, created the smallest increase since December 2021, est. 5.5%, last 5.7%.

Iron Ore Key Indicators:

• Platts62 $123.75, +1.90, MTD $124.40. The import margin vanished again for mid-grade and high grade as the quick push on iron ore index. However there are import margin for low grade and discount cargoes. There were two 170,000mt April laycans of PBF traded at Index+ $1.1/1.2 premium, higher than previous $0.7-0.8 two weeks ago, indicated the market was optimistic on the warm season coming soon.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 14th)

• Futures 105,149,700 tons(Increase 260,100 tons)

• Options 81,261,800 tons(Increase 1,237,500 tons)

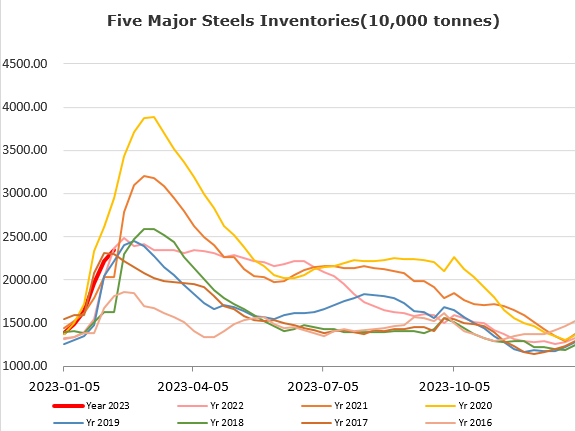

Steel Key Indicators:

• CISA statistic indicated that China imported 10.57 million tons of finished steels in 2022, refreshed a 19-year low.

Coal Indicators:

• The FOB Australia coking coal PLV extened growth by $5 on the index. A deal was completed at $380 FOB Australia for 40,000mt PMV Illawarra, for March laycan. A bid was heard at $400 for 40,000mt HCCA branded coal.