Verdict:

• Short-run Neutral to Bullish.

Macro:

• UK and US imposed sanctions on Russia metals including copper, aluminum and nickel. LME announced a suspension of warehouse warrant for Russian metals produced after April 13th.

• From April 1st, China Shanxi province raised mineral resource tax from 8% to 10%, processing tax from 1.5% to 2%.

Iron Ore Key Indicators:

• Platts62 $112.00, +3.35, MTD $103.72. The strong sentiment of physical and futures price failed to spur the physical trade volume last week. Traders were waiting for slight lower opportunities when market start to stablise. Rio traded 170kt PBF at May index plus a $1.4 premium.

• The 45 China ports iron ore inventories reached 144.87 million tons, up 351,000 tons on the week. Daily average evacuation at 3.02 million tons, up 108,400 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 12th)

• Futures 114,138,100 tons(Increase 519,200 tons)

• Options 125,567,300 tons(Increase 2,436,000 tons)

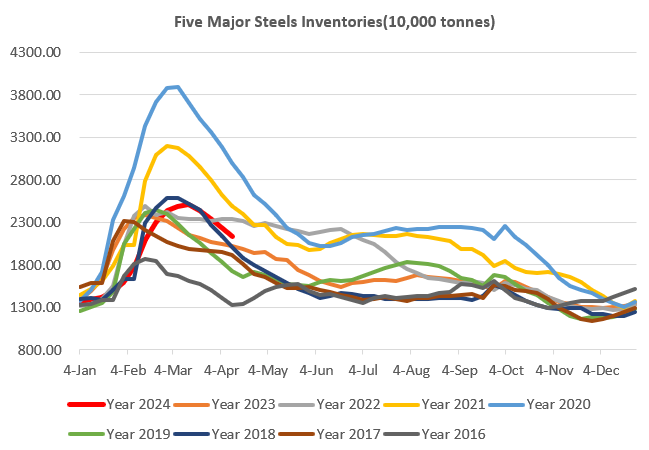

Steel Key Indicators:

• The utilization rate of China blast furnace ironmaking in 247 steel mills was 84.05%, an increase of 0.44% month on month and a decrease of 7.75% year-on-year. The average production capacity utilization rate China independent arc furnace steel mills were 50.55%, a decrease of 1.53% month on month and 13.40% year-on-year.

Coal Indicators:

• The significant rebound in the futures market has driven the sentiment of spot rebound, and after seeing a significant increase in buying inquiries, offers began to retreat. However, the rebound sentiment in the FOB Australian market was cautious, currently only rebounding $3.5 from the periodic low, a subtle increase compared with the big correction previously.