Verdict:

• Short-run Neutral to Bearish.

Macro:

• US April PPI up 0.5% on the month, est. 0.3%, last 0.2%. US April PPI up 2.2% on the year, est. 2.2%, last 2.1%.

• US president Joe Biden was raising levies on semi-conductors, batteries, solar cells and some critical minerals, in addition to last reported on steel, aluminum and EVs.

Iron Ore Key Indicators:

• Platts62 $117.25, +0.65, MTD $117.33. There was a trade by BHP for MACF June laycan at $109.1/mt. The buyers emerged eyeing the drop of price, which supported the iron ore market.

SGX Iron Ore 62% Futures& Options Open Interest (May 14th)

• Futures 113,588,900 tons(Increase 1,362,300 tons)

• Options 138,360,200 tons(Increase 2,007,500 tons)

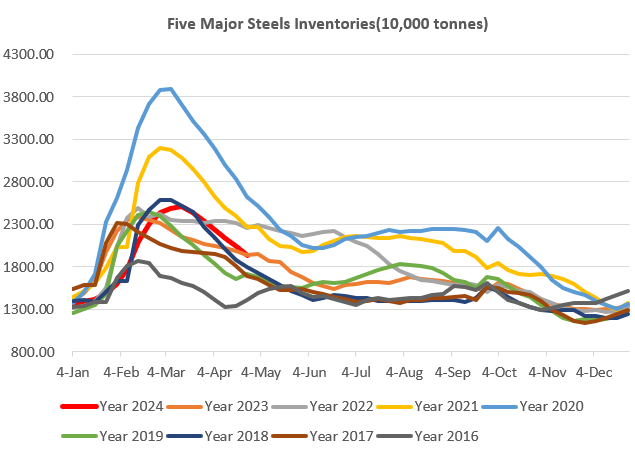

Steel Key Indicators:

• MySteel estimated 91 China blast furnace mills average cost of rebar at 3509 yuan/ton, down 43 yuan/ton, or 1.2% on the month, average profit at 76 yuan/ton, up 194 yuan/ton.

Coal Indicators:

• The bid became lower yesterday, which widened the offer-bid spread. Thus, index went down as no reply from buyers after outstanding offers showed for many days.