Market Verdict on Iron Ore:

• Neutral.

Macro

• “Hawkish” U.S. Federal official James Bullard favors 75 basis point hike in July, reversed previous view on 100 basis points. FedWatch suggested that the probability of 100 bp hike dropped from 80% to 45% in a day.

• China NDRC indicated that the 3% CPI target was achievable.

• China Q2 GDP growth rate 0.4% on the year, est. 1%, last 4.8%. China H1 housing development investment down 5.4% on the year. Merchandising houses sales at 689.23 million square meters, down 22.2%.

• China H1 industrial added value above designated scale up 3.4%, est. 3.5%, last 3.3%.

Iron Ore Key Indicators:

• Platts62 $109.40, +3.60, MTD $112.14. Chinese steel mills expected that margin could recover with initiative control on production in June and July. Thus, Chinese blast furnace utilisation rate drop by more than 3% in June on the month. Seaborne float premium on PBF maintained around $0.55 to $0.65 on MOC platform over the last two months, however lack of buying interested on float basis cargoes. Newman fines saw discount first time in the year. However seaborne trades through float basis were light in general. JMBF cargoes saw ample interests and trades, discount improved from $8.7-8.9 to $8.3.

• MySteel 45 ports iron ore inventories at 130.28 million tons, up 3.74 million tons w-o-w. Daily evacuation 2.74 million tons, down 144,500 tons w-o-w. Australia iron ore 61.03 million tons, up 1.12 million tons w-o-w. Brazil iron ore 42.69 million tons, up 1.1 million tons w-o-w. 108 ships at ports, up 11.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 14th)

• Futures 93,705,300 tons(Increase 2,435,000 tons)

• Options 82,185,500 tons(Increase 685,000 tons)

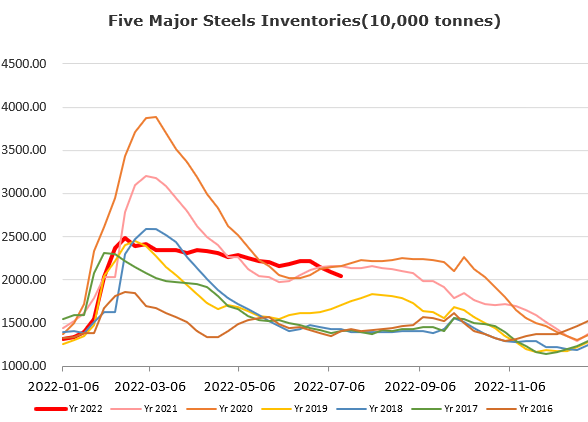

Steel Key Indicators

• Tangshan average billet cost 4030 yuan/ton, down 131 yuan/ton on the week, average loss at 382 yuan/ton.

Coal Indicators

• FOB Australia market concluded 75,000mt PMV at $235/mt with mid-August laycan. Platts indicated that participants with fixed-price trade as signs of stablisation of market although a slight correction over the week, with growing Indian end-users’ inquiries.

• Chinese Shandon steel mills started to decrease purchase price on coke for the second round by 200 yuan/ton.