Verdict:

• Short-run Neutral to Bullish.

Macro:

• China announced reserve requirement ratio cut by 0.25% to consolidate the foundation for economy recovery. The reduction is the second RRR cut during 2023, expected to release over 500 billion yuan in medium liquidity.

Iron Ore Key Indicators:

• Platts62 $123.95, +1.45, MTD $120.11. The seaborne iron ore market saw improved popularity because of the stocking demand from China mid-autumn and national holiday. Moreover, the crude oil rebound lifted the commodity sector in general.

• 45 China ports iron ore inventories at 118.66 million tons, down 21,200 on the week. Daily evacuation at 3.2379 million tons, up 113,800 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 14th)

• Futures 127,100,600 tons(Increase 3,066,000 tons)

• Options 115,130,200 tons(Increase 4,683,600 tons)

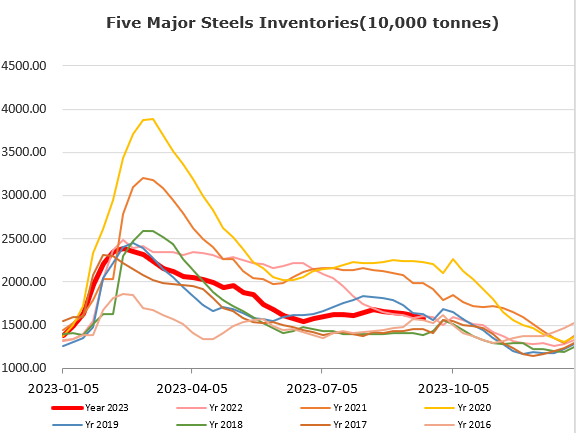

Steel Key Indicators:

• China 247 sample steel mils pig iron production at 2.4784 million tons per day, down 4,000 tons on the week.

Coal Indicators:

• BHP suspended the operation of Peak Downs area because of a truck accidents. As a result, some laycans were delayed at ports.