Market Verdict on Iron Ore:

• Neutral.

Macro

• U.S. November PPI up 0.8% m-o-m, created a seven-month high. Est. up 0.5%. Last up 0.6%.

• China NDRC and MIIT departments published documents to supervise commodities price movement, to increase supply on upstream commodities and utilise national reserve.

Iron Ore Key Indicators:

• Platts 62 $108.25, -1.95, MTD $104.20. Steel mills were conservative on the production schedules, which created a bottleneck on marginal demand for iron ores. Both seaborne and domestic market were light. However China political conference mentioned a stablised growth on infrastructure, which were slight over-expected to investors.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 14th)

• Futures 82,939,000 tonnes(Increase 947,300 tonnes)

• Options 56,894,000 tonnes(Increase 885,000 tonnes)

Steel Key Indicators

• CISA deputy secretary Shi Hongwei indicated China crude steel production 1.065 brillion tonnes, apparent consumption 990 million tonnes. The future crude steel production and consumption expected to maintain in high level, however the growth rate expected to become smaller.

• CISA deputy chairman Qu Xiuli indicated that the crude steel production down 4-5% compared to last year, created the first negative production growth year since 2015.

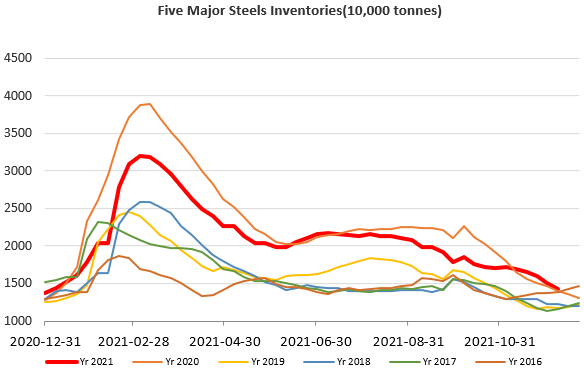

• China construction steel production 3.897 million tonnes, down 30,500 tonnes w-o-w. Mills inventory 2.786 million tonnes, down 314,100 tonnes w-o-w. Circulation 5.41 million tonnes, down 435,600 tonnes w-o-w.

Coal Indicators

• China coal news indicated that coking coal supply expected to become tight and demand potentially warm up due to winter stock. Shanxi and Shannxi area increased prime coking price by 150 yuan/tonne early this week.