Verdict:

• Short-run Bearish.

Macro:

• The world bank published global economy outlook, mentioned global economy growth by 2.4% in 2024, unchanged with expectation at June 2024. The estimated growth rate of 2025 reached 2.7%, 0.3% lower than expected.

• Rio Tinto published Q4 production and consumption report, Q4 iron ore production at 87.5 million tons, up 5% on the quarter. Total production in 2023 reached 332 million tons, up 2%. Total iron ore delivery in 2023 reached 86.3 million tons, up 3% on quarter, down 1% on the year. Total iron ore delivery in 2023 reached 332 million tons, up 3% on the year.

Iron Ore Key Indicators:

• Platts62 $128.95, -2.25, MTD $137.94. China steel mills winter stock mostly completed, most of demand concentrated to spot cargoes. Seaborne trade was quiet except some Brazil cargoes with higher grade. There was fixed trade of NHGF at $128.3/mt yesterday and two laycans of PBF at float price $2.3/mt after the mid-grade absence for few days. Some mills have to extend maintenance due to the poor margin. Oversupply of half-finished steels became significant in northern provinces of China.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 15th)

• Futures 114,866,100 tons(Decrease 102,200 tons)

• Options 98,701,600 tons(Increase 1,296,500 tons)

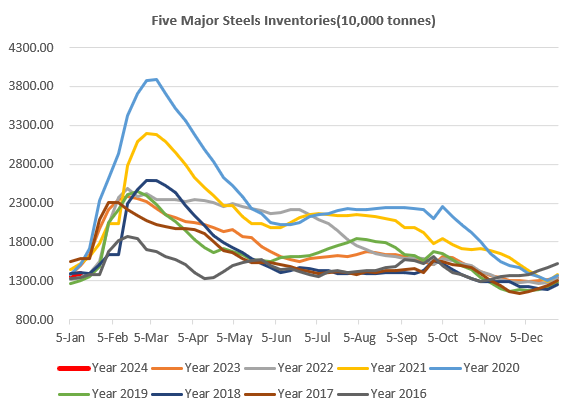

Steel Key Indicators:

• Most of steel mills in China announced the New Year break holidays, except few southern EAFs would produce through the holiday time.

Coal Indicators:

• Worker fatally crushed at Saraji coal mine in Queensland. The operation at Saraji mine suspended and investigation had been launched. The area produced 9.19 million tons of coking coal in 2023. Most of production was premium coking coal with Saraji brand.