Market Verdict on Iron Ore:

• Neutral.

Macro:

• IEA predicted that the crude oil demand expected to increase 200 million barrels/day, reaching 101.9 million barrels/day. However the restriction of Russia supply and economy recovery globally potentially cause a shortage.

Iron Ore Key Indicators:

• Platts62 $123.60, -0.15, MTD $124.32. The import margin vanished again for mid-grade and high grade as the quick push on iron ore index. However there are import margin for low grade and discount cargoes. There were two 170,000mt April laycans of PBF traded at Index+ $1.1/1.2 premium, higher than previous $0.7-0.8 two weeks ago, indicated the market was optimistic on the warm season coming soon.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 15th)

• Futures 107,091,500 tons(Increase 1,941,800 tons)

• Options 81,786,300 tons(Increase 524,500 tons)

Steel Key Indicators:

• Tangshan average billet cost 3895 yuan/ton, up 11 yuan/ton. Average steel mill loss at 95 yuan/ton, decreased by 19 yuan/ton.

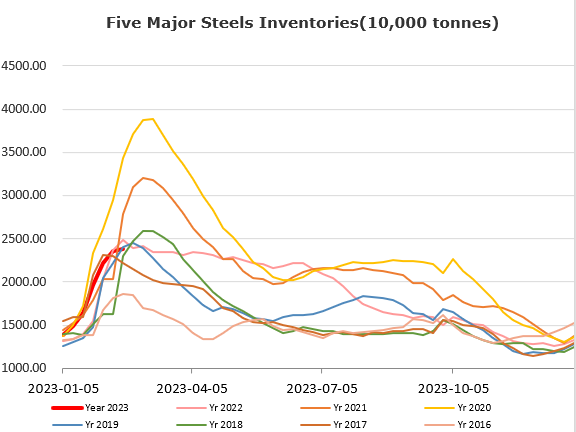

• CISA statistic indicated that member steel mills daily production 2.06 million tons in early February, up 3.77% from late January. Steel inventories 18.03 million tons, up 9.36% from late January.

Coal Indicators:

• A deal was completed at $380 FOB Australia for 40,000mt PMV Illawarra, for March laycan. A bid was heard at $400 for 40,000mt HCCA branded coal.