Market Verdict on Iron Ore:

• Neutral to bearish.

Macro:

• The Federal Reserve interest rate swap indicated that the interest rates potentially decrease by 100 basis points before December.

• US PPI rose 4.6% year-on-year in February, estimated 5.4%, and the previous value was revised to increase 5.7%; A month-on-month decrease of 0.1%, an expected increase of 0.3%, and a revised increase of 0.3% from the previous number. Core PPI was flat on a month-on-month basis, with an expected increase of 0.4%; The year-on-year increase was 4.4%, and the expected increase was 5.2%.

Iron Ore Key Indicators:

• Platts62 $133.10, +0.10, MTD $129.10. The secondary market saw active trades, PBF premium for May at $1.45, which was high considering a fast increased index. PBF premium raised fast from $0.8 to $1.45 during the past two weeks. BHP sold JMBF at $4.5 discount, narrowed $0.2 during this week. In general, the market saw improved PBF premium and narrowed BHP discount, because of the recovered steel margin.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 15th)

• Futures 108,929,600 tons(Increase 1,726,600 tons)

• Options 89,626,100 tons(Increase 4,674,500 tons)

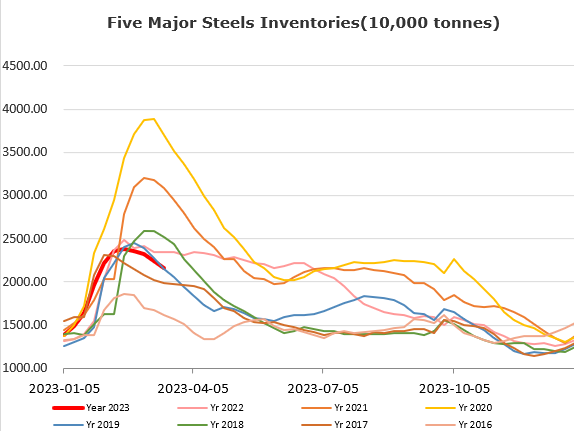

Steel Key Indicators:

• China crude steel production expected to increase 15 million tons during first quarter compared to last Q1, which beyond expected 10 million tons. Thus, some market participants indicated that the earliest production control schedule should come in Q2.

Coal Indicators:

• Metal Expert indicated that a physical coal trader said Tangshan Custom removed all bans on Australia coal import, although there is yet any official notification from Beijing.