Verdict:

• Short-run Neutral.

Macro:

• China March CPI fell 1.0% on the month, up 0.1% on the year.

• After the sanction imposed from UK and US on Russia aluminum, Russian Aluminium giant Rusal said that new sanctions would have no impact on its supply to world market.

Iron Ore Key Indicators:

• Platts62 $113.05, +1.05, MTD $104.65.

• China iron ore arrivals at 45 ports at 25.28 million tons during past week, up 915,000 tons on the week. The arrivals at northern six ports at 12.25 million tons, up 1.335 million tons on the week.

• MySteel estimated iron ore total delivered 19.19 million tons, down 7.75 million tons on the week. Australia delivered 14.47 million tons, down 4.08 million tons on the week. Brazil delivere4d 4.73 million tons on the week, down 3.67 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 12th)

• Futures 114,360,900 tons(Increase 222,800tons)

• Options 126,317,400 tons(Increase 750,100 tons)

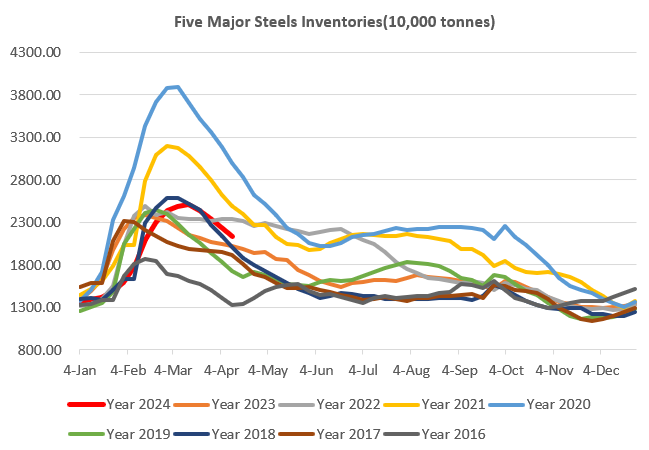

Steel Key Indicators:

• CISA indicated the member steel enterprises produced 2.11 million tons of crude steel on daily basis in early April, down 0.47% from late March, down 9.05% on the year.

Coal Indicators:

• The physical market tested growth at $1-2/mt per day, supported by huge growth in the paper market. The traders were waiting for the real direction emerge on steel market in Asia.