Market Verdict on Iron Ore:

• Neutral.

Macro

• China lowered the mortgage rate for homebuyers and announced a phased reopening of shops in Shanghai due this Monday. The China Central Bank PBOC on Sunday cut the lower-bound range of mortgage interest rates from 4.6% to 4.4%.

• IEA expected that the global crude oil daily demand would drop from 4.4 million barrels in Q1 to 1.9 million barrels in Q2.

Iron Ore Key Indicators:

• Platts62 $127.55, -5.95, MTD $135.46. Seaborne PBF obtained growing interests, in particular after price correction. However buyers are still preferring MACF. China MACF at port areas decreased fast. South Flank mines expected to ship more MACF to China. 65-62 spread remained narrow around $23 because of the thin steel margin. Some traders indicated that mills resold Carajas fine considering the cost. SSF discount narrowed for consecutive months while SSF/PBF ratio also narrowed, indicating the low grade fines are favorable options for end-users to optimise cost-efficiency.

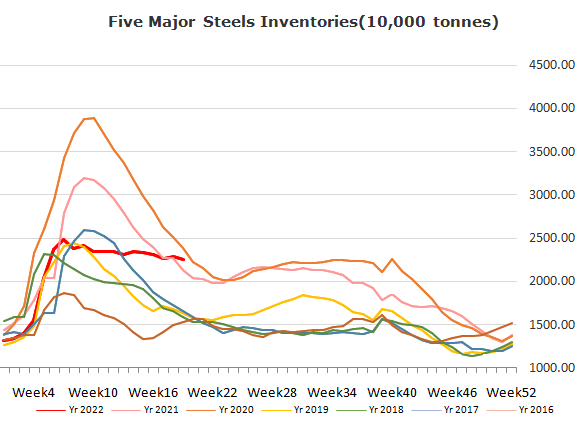

Steel Key Indicators

• Mysteel researched 247 blast furnace operation rate at 82.61%, up 0.7% w-o-w. Utilisation rate 88.28%, up 0.53% w-o-w. Daily pig iron production 2.38 million tonnes, up 14,400 tonnes.

Coal Indicators

• China National Development and Reform Commission: signing medium and long-term coal contracts is important to stabilize the coal supply and demand and promote the consistent development of upstream and downstream. The government encourages and supports long-term sales contract equal to or longer than 1 year.