Market Verdict on Iron Ore:

• Neutral.

Macro

• Chinese central bank PBOC lowered one-year length Medium Lending Facility rate from 2.85% to 2.75%. Market expect Loan Prime Rate in China should follow the decrease soon.

• NAHB/Wells Fargo Housing Index(HMI) decrease 6 to 49, created the eighth consecutive monthly decrease. The number was also the lowest since 2014, which indicated the U.S. economy was slowing down.

Iron Ore Key Indicators:

• Platts62 $104.40, -4.45, MTD $108.61. The current market interests were centered around mid-grade including PBF and NMF, because of the cost-efficiency and production recovery in China. In addition, the demand raw materials recovered significantly in southeastern mills. The term contract discounts for FMG and BHP in August widened. However be aware of PBF was slight oversupplied in seaborne market, which might limit the room of growth in the near future.

• MySteel 19 ports of Australia and Brazil delivered 23.979 million tons of iron ore, down 2.135 million tons w-o-w. Global iron ore delivery 28.49 million tons, down 2.729 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Aug15th)

• Futures 94,980,600 tons(Increase 383,200 tons)

• Options 91,718,500 tons(Increase 611,600 tons)

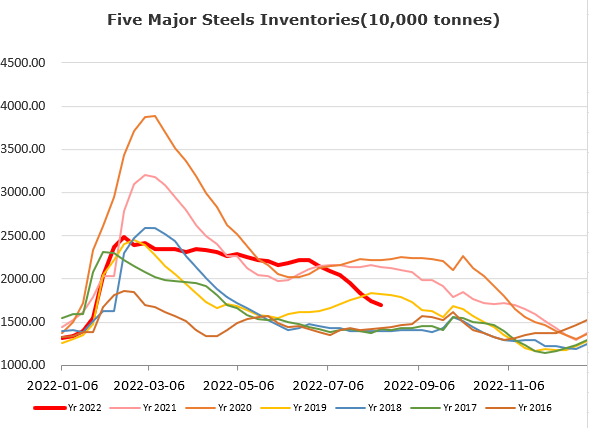

Steel Key Indicators

• MySteel estimated 85 individual EAFs average operation rate at 57.34%, up 1% on the month, down 12.96% on the year.

Coal Indicators

• Australia met coal remain in rising trend. Physical spot cargoes were supported by higher futures price as well as contango structure.