Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• U.S. PPI up 0.2% in October from September, est. up 0.4%. October PPI up 8% on the year, est. up 8.3%. Core PPI up 6.7% on the year, est. 7.2%.

• U.K. P.M. Rishi Sunak announced to increase the minimum wage from GBP9.5 to GBP 10.4, with total amount GBP8 -11 million.

Iron Ore Key Indicators:

• Platts62 $95.70, +0.40, MTD $88.45. Iron ore saw an uptick supported by both marginal ease expectation on epidemic control in China as well as solid measures to back housing market. However, seaborne buying interest maintained weak for two weeks, although the import loss almost disappeared. BHP sold a 90,000mt NHGF at $94.9/dmt for December laycan. Float basis NHGF premium around $1, PBF premium around similar level, both based on December Index. Both seaborne and portside liquidity were poor.

• Last week, 45 Chinese ports iron ore arrived 25.589 million tons, up 2.84 million tons on the week. 19 Australia and Brazil iron ore shipment at 23.587 million tons, down 2.662 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 15th)

• Futures109,343,400tons(Increase3,250,000tons)

• Options84,034,500tons(Increase667,500tons)

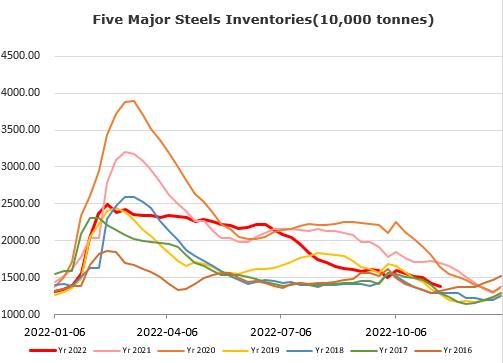

Steel Key Indicators:

• Mysteel researched 247 blast furnace operation rate at 77.21%, down 1.57% w-o-w. Utilisation rate 84.09%, down2.23% w-o-w.

Coal Indicators:

• Chinese physical coke decreased three rounds total 300 -330 yuan/ton. Coke plants utilisation rate was in low area. Market participants believed it was difficult to see further cut on coke output.