Market Verdict on Iron Ore:

· Neutral to bearish.

Macro

· The United Nations issued the year 2021 World Trade Outlook, indicated China economy developed to counter against recession. The China economy boomed earlier than any other country after the pandemic. The China trade volume increased by 10% compared to last H1.

Iron Ore Key Indicators:

· Platts62 $113.40, -6.95, MTD $131.48.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 15th)

· Futures 74,910,600 tonnes(Increase 443,400 tonnes)

· Options 87,550,500 tonnes(Increase 1,042,500 tonnes)

Steel Key Indicators

· Tangshan Steel pre-tax cost 3723 yuan/tonne, average billet cost 4726 yuan/tonne, up 62 yuan/tonne. Steel margin 494 yaun/tonne, up 38 yuan/tonne.

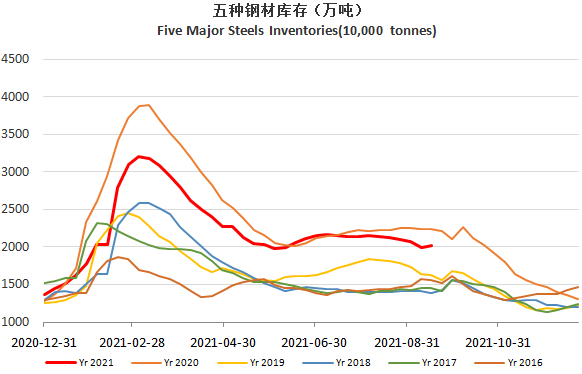

· MySteel Rebar Inventory: Rebar production 3.07 million tonnes, down 6.14% w-o-w. Mills inventory 3.21 million tonnes, up 4.94% w-o-w. Circulation inventory 7.51 million tonnes, up 2.78% w-o-w.

· China National Bureau of Statistic indicated China August crude steel daily production 2.685 million tones, down 4.1% m-o-m, created the lowest since the April of 2020.

Coal Indicators

· China Zhengzhou Commodity Exchange started a new open position limit on daily basis of 100 lots in Oct21, Nov21 and Dec21 contract.