Verdict:

• Short-run Neutral.

Macro:

• ECB’s member Gediminas Simkus said investors are far less optimistic than markets on rate cuts. The salaries statistics were considered important.

• China Premier Li Qiang attended the World Economic Forum 2024 Annual Meeting at the Davos and delivered a special speech, expected GDP growth about 5.2%, higher than the 5% estimated by beginning of 2023.

Iron Ore Key Indicators:

• Platts62 $129.45, +0.50, MTD $137.17. The rumor that 1 trillion yuan specialised debts from China supported the iron ore growth overnight. However, mills were not confident to make purchases on seaborne cargoes given a worse condition of margins. There was a 170kt PBF traded at $127.4/mt, the first PBF fixed trade saw over a week.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 16th)

• Futures 115,019,500 tons(Increase 153,400 tons)

• Options 100,516,600 tons(Increase 1,815,000 tons)

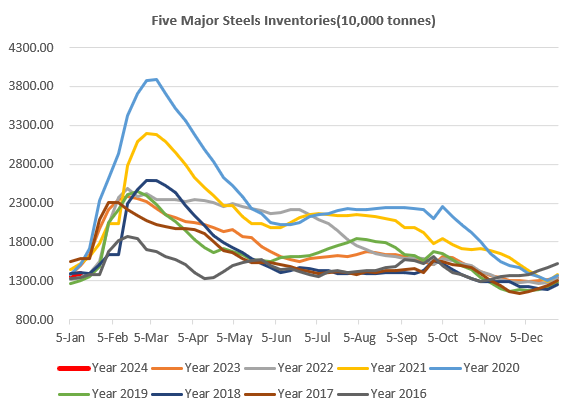

Steel Key Indicators:

• Most of China steel mills announced unchanged for ex-work steel price in February. The daily trade volume drops significantly as the completion of winter stock.

Coal Indicators:

• The fatal accident in Saraji mine in Australia forced miner to withdraw 40,000mt of selling interest on PMVs. It is hard to estimate how many delayed cargoes will be impacted in February. The traders were also concerned about the wet weather, which potentially increase the tightness of supply in short-run.