Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. last week jobless claims 194,000, est. 200,000, last 195,000.

• China MIIT urged to increase the merging and restructure of domestic steel industries, improving the quality of steels.

Iron Ore Key Indicators:

• Platts62 $124.75, +1.15, MTD $124.36. Fixed trades in mid-stream largely represent the strong physical market sentiment. Seaborne trades became popular again with steel sales improved during past few days. Rio Tinto sold PBF at $126. Vale sold BRBF at $130.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 16th)

• Futures 107,965,500 tons(Increase 874,000 tons)

• Options 83,015,600 tons(Increase 1,229,300 tons)

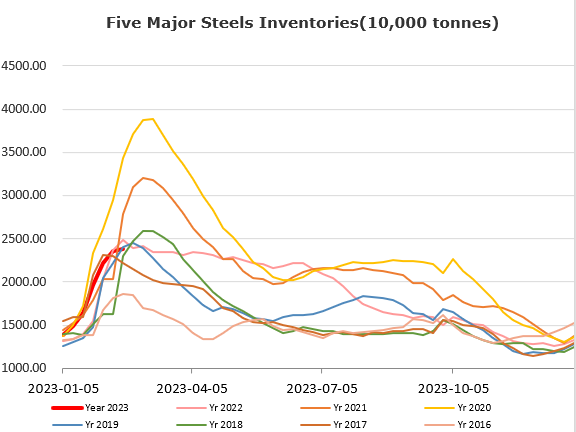

Steel Key Indicators:

• MySteel researched 137 sample mills rebar production 2.63 million tons, up 172,400 tons on the week.

Coal Indicators:

• A bid was heard at $400 for 40,000mt HCCA branded coal for few days, but no trade was reported yet. The PLV market was waiting for direction and become quiet.