Market Verdict on Iron Ore:

• Neutral.

Macro:

• ECB official indicated that to stop interest hike or to increase by 25 bps or potentially become major decision of the next meeting, instead of a 50bps hike.

Iron Ore Key Indicators:

• Platts62 $118.90, -0.05, MTD $120.42. Physical traders expected active trading activities recovered with some small trade, with more float basis instead of fixed price. PBF float rebounded to $2 from $ 1 based on May average seeing from late March.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 14th)

• Futures 94,828,300 tons(Decrease 120,600 tons)

• Options 102,805,500 tons(Increase 515,000 tons)

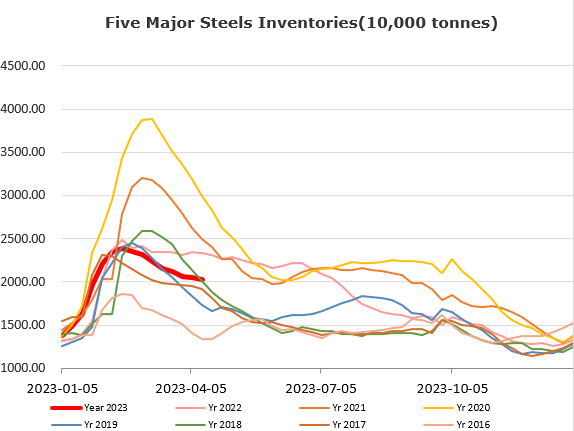

Steel Key Indicators:

• Some western Chinese EAFs stopped because of short of raw materials and capacity issues. MySteel estimated 4165 yuan/ton, down 25 yuan/ton. Average production loss at 71 yuan/ton.

Coal Indicators:

• Australia FOB market saw ample supply on spot cargo, which potentially provide downward pressure on the market. There was offer of a 75,000mt globalCOAL cargo, which decreased by $7 last Friday with no bid seen.