Market Verdict on Iron Ore:

• Neutral to Bullish.

Macro:

• The Chinese NBS statistic indicated that property investment decreased by 6.2% from January to April, which was 5.8% from January to March. The decrease was slight faster than market expectation.

• Fu Linghui, spokesperson for the National Bureau of Statistics of China, stated that the current low price movement in China should be periodical, and there is currently no deflation signal in the economy. However, the periodic low level of year-on-year CPI growth will continue for more quarters. China surveyed jobless rate in urban areas in April at 5.2%, est. 5.3%, last 5.3%.

Iron Ore Key Indicators:

• Platts62 $108.40, unchanged, MTD $106.04. Eastern Chinese ports maintained active trades, however northern ports were quiet. FMG traded 188,000mt FBF at IODEX62% and a discount of 4.4%. The MACF discount narrowed from $2.6 to $2.3.

SGX Iron Ore 62% Futures& Options Open Interest (May 16th)

• Futures 90,408,900 tons(Increase 760,800 tons)

• Options 107,589,400 tons(Increase 1,535,500 tons)

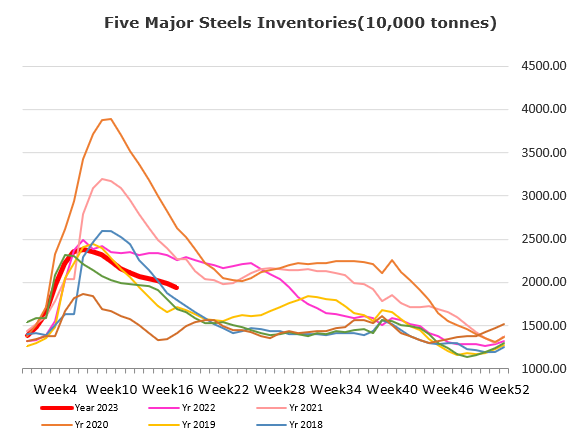

Steel Key Indicators:

• The April Chinese pig iron produced 77.84 million tons, up 1.0% on the year. Steel produced 119.95 million tons, up 5.0% on the year.

Coal Indicators:

• The FOB Australia coking coal market inched down because of the current supply increase in both PLV and PMV market. Thus, buyers started a waiting mode. It is not clear whether the ample supply would be sustainable in late half of June.