Market Verdict on Iron Ore:

· Neutral.

Macro

· NAHB/Wells Fargo Housing Index(HMI) decrease 6 to 49, created the eighth consecutive monthly decrease. The number was also the lowest since 2014, which indicated the U.S. economy was slowing down.

· AFS: Global automobile market decreased 2.9973 million units, expected to decrease 3.8262 million units because the lack of semi-conductors.

Iron Ore Key Indicators:

· Platts62 $104.05, -0.35, MTD $108.20. Both seaborne and portside market saw a cooling down on buying interest during the week. PBF inventories at Shandong reached 5 million tons, which were 5 times bigger than normal inventories level in previous few years. Thus, PBF sellers expected to complete the deal before landing on ports. The trades potentially shift from sellers’ option to buyers side. On the discount market, MACF regained buying interest and traded in both fixed and float price. The fixed price traded in range $97-98, and float trade has a $10.3-10.5 discount based on September Index.

· The front month spreads expected to have some more room to grow, in particular Sep-Oct, or Oct-Nov, due to the acceleration on Chinese mills production recovery, which would bring back some prompt demands to this market.

SGX Iron Ore 62% Futures& Options Open Interest (Aug16th)

· Futures 95,704,900 tons(Increase 724,300 tons)

· Options 92,091,500 tons(Increase 373,000 tons)

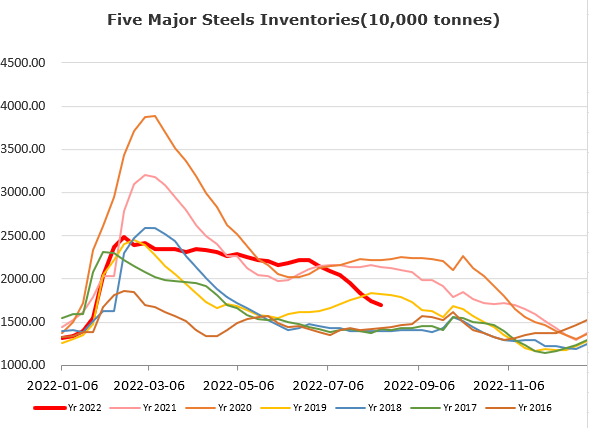

Steel Key Indicators

· Eastern Chinese Mills increased purchase price of scrap by 700 yuan in July for several rounds, recovered most of losses in June.

Coal Indicators

· Australia met coal remain in rising trend. Physical spot cargoes were supported by higher futures price as well as contango structure.

· Chinese NDRC held conference to release capacity on prime coals and guarantee long-term contract volume to power plants.