Market Verdict on Iron Ore:

• Neutral.

Macro:

• The first day of Chinese National Congress stressed emphasis on real economy support, accelerating the industrialisation, manufacturing, product quality, aerospace, and digital development.

• ECB official indicated that the 75 bps hike in October was appropriate. BOE indicated that interest rate should be raised to meet with inflation target.

Iron Ore Key Indicators:

• Platts62 $96.15, +1.95, MTD $96.08. The trade activity significantly improved after Chinese golden weeks. JMBF discount narrowed from $4.5 to $2.9 across holiday. PBF premium improved from 0 to $2 during same period. BRBF and Brazil mid-grade maintain popularities, however the decreased alumina premiums indicated a slight oversupply on the relevant cargoes on seaborne market. Nov- Dec 23 spread in SGX increased from $0.35 to $1.55 during the previous 5 weeks, with limited growth on the outright side. The fast expansion of the spread potentially was due to the demand market difference on early Q4 and late half of Q4 in China. The continuous production cut and incoming environment protection actions before important national congress in China boosted the lump premium from $0.1 dmtu in mid-September to $0.2475 dmtu early this week. Market participants believed a follow-up growth as the physical supply was still tight at the current 2-3 weeks.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 14th)

• Futures 94,826,300 tons(Increase 275,700 tons)

• Options 81,244,400 tons(Increase 2,842,500 tons)

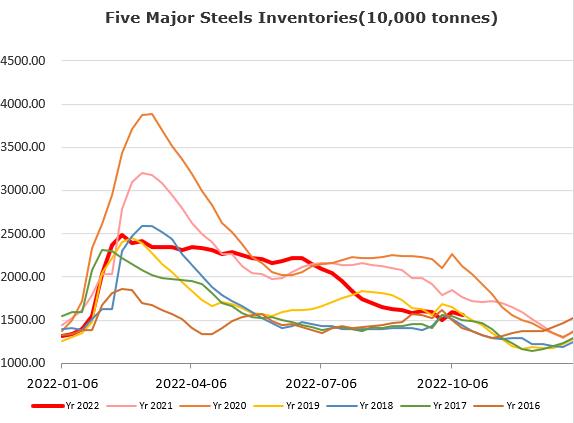

Steel Key Indicators:

• Tangshan lifted the sintering control in Tangshan from October 11-16th.

Coal Indicators:

• FOB Australia coking coal slightly upticked after a previous PLV trade reported done at $285 for 35,000mt cargoes from globalCOAL last week. The most recent source was a bid increased from $283 to $285, 75,000mt PMV. Index increase was related to the concerns on the supply tension.