Verdict:

• Short-run Neutral.

Macro:

• Russia increased crude oil export tax to $26.2/mt effective from November 1st.

• China listed companies started to unveil buyback plans. The companies were state-owned giants including Sinopec, Baoshan Iron and Steel and COSCO. Market participants expected more buyback plans emerged in the rest of October.

Iron Ore Key Indicators:

• Platts62 $120.15, +1.70, MTD $118.35. China 45 ports iron ore arrivals increased by 7.03 million tons significantly to 27.38 million tons last week, up 6.26 million tons y-o-y. The PBF and SSF spread narrowed significantly during the past five weeks from 150 yuan/ton to 85 yuan/ton, due to the fast narrowing steel margin in China, which supported the low grade demand. At the same time, the SSF stocks decreased significantly during the past three months. There were fixed NHGF, PBF and MACF traded yesterday.

• Rio Tinto Pilbara miner produced 83.5 million tons of iron ore in Q3, up 3% compared to Q2, down 1% y-o-y. Pilbara delivered 83.9 million tons of iron ore in Q3, up 6% from Q2, up 1% y-o-y. Rio Tinto maintained its annual delivery guidance at 320 -335 million tons in 2023.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 16th)

• Futures 125,374,300 tons(Increase 2,400,500 tons)

• Options 114,335,600 tons(Increase 344,800 tons)

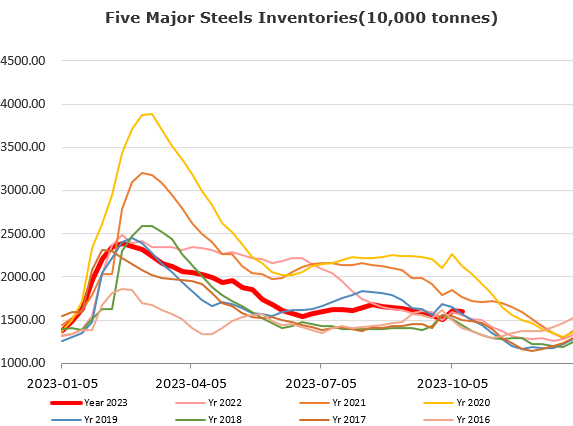

Steel Key Indicators:

• The European Service Center indicated that HRC price should have limited downside room. The current deals concluded at EUR 630 -640/mt were closed to production cost.

Coal Indicators:

• The FOB Australia coking coal market heard a PMV deal concluded at $355/mt. The index was unchanged for many trading days.