Market Verdict on Iron Ore:

• Neutral.

Macro:

• UK CPI up 11.1% in October, refreshed the highest since 1982, est. 10.7%, last 10.1%.

• U.S. November NAHB housing index at 33, refreshed new low since April 2020, est. 36, last 38.

Iron Ore Key Indicators:

• Platts62 $98.10, +2.40, MTD $89.25. Iron ore saw an uptick supported by both marginal ease expectation on epidemic control in China as well as solid measures to back housing market. However, seaborne buying interest maintained weak for two weeks, although the import loss almost disappeared. BHP sold a 90,000mt NHGF at $94.9/dmt for December laycan. Float basis NHGF premium around $1, PBF premium around similar level, both based on December Index. Both seaborne and portside liquidity were poor.

• MySteel researched 17 steel mills received unofficial production cut notices. Six mills production cut at 15-30%. Sintering ores expected to reduce 11,000 tons per day.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 16th)

• Futures 112,316,300 tons(Increase 1,075,100 tons)

• Options 87,138,900 tons(Increase 2,076,500 tons)

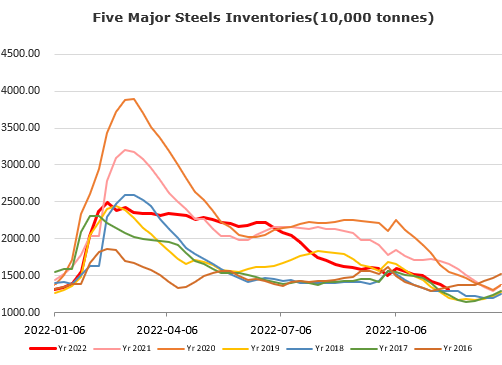

Steel Key Indicators:

• Tangshan average billet cost 3644 yuan/ton, down 16 yuan/ton. Average steel mill lost 84 yuan/ton, down 86 yuan/ton.

• The ASEAN steel association secretary Yeoh Wee Jin indicated to increase steel capacity by 90.8 million tons to 164.8 million tons.

Coal Indicators:

• Chinese physical coke decreased three rounds total 300 -330 yuan/ton. Coke plants utilisation rate was in low area. Market participants believed it was difficult to see further cut on coke output.