Verdict:

• Short-run Neutral.

Macro:

• BHP produced 72.67 million tons of iron ore in its Pilbara mining area, up 4.6% from Q3, down 2.2% on the year. BHP sold 70.34 million tons of iron ore, down 2% from Q3, down 3.2% on the year. BHP produced 11.4 million tons in Q4, up by 2% on the quarter, down 18% on the year. BHP revised annual guidance from 56- 62 million tons to 46 – 50 million tons.

• China NBS: Crude steel produced 67.44 million tons in December. Total produced 1.019 billion tons of crude steel in 2023.

Iron Ore Key Indicators:

• Platts62 $127.65, -1.80, MTD $136.38. Iron ore market suffered correction by the general loss on global equity market. However the recovery should return as the macro impact normally price-in quickly. There was no seaborne trade yesterday, the fundamental market still in sluggish mode as the pig iron demand is on decreasing trend before Chinese New Year.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 17th)

• Futures 115,772,700 tons(Increase 753,200 tons)

• Options 102,557,800 tons(Increase 2,041,200 tons)

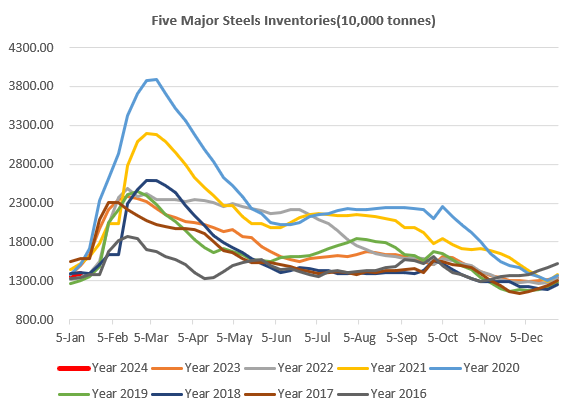

Steel Key Indicators:

• China Tangshan average billet cost 3869 yuan/ton, down 58 yuan/ton on the week.

Coal Indicators:

• Some China end-users started to seek alternatives coking coal since the operation resumption yet to see positive updates. The market was concerning on the supply decreasing from miner and the bad weather. On the other side, the looming Chinese New Year decreased steel production significantly, which could limit the upside room for the current price level.