Verdict:

• Short-run Neutral.

Macro:

• ECB governor Joachim Nagel believed that there was increasing probability for a rate cut in June. However the decision needed to confirm the inflation rate is really going down by then.

Iron Ore Key Indicators:

• Platts62 $116.60, +6.20, MTD $106.13. The resumption of production in China steel mills supported the iron ore usage. The rebar apparent consumption statistic by Ganggu indicated a fast recovery on production side. There were couple different seaborne trades yesterday including two PBF laycans and IOCJ laycan. The high premium trade became active as demand growth as well as recovered physical margin.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 17th)

• Futures 117,045,700 tons(Increase 3,933,600 tons)

• Options 132,073,400 tons(Increase 3,182,500 tons)

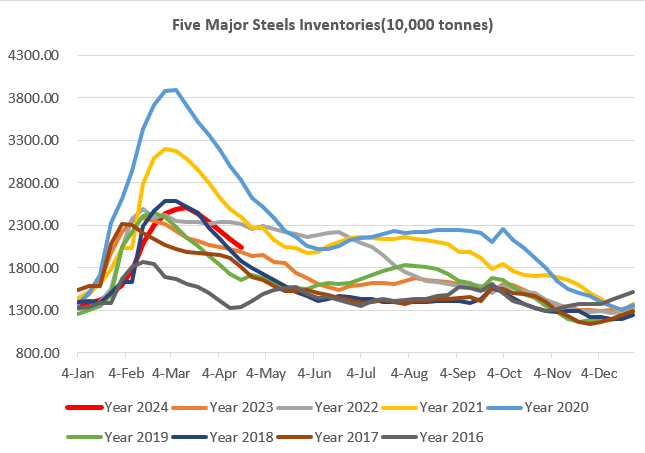

Steel Key Indicators:

• China March crude steel produced 88.27 million tons, down 7.8% on the month. Jan- Mar total produced 256.56 million tons, down 1.9% on the month.

Coal Indicators:

• After 800-880 yuan/ton drop on China physical coke, cokery plants first time increase coke price by 100-110 yuan/ton for Hebei and Shandong mills