Market Verdict on Iron Ore:

• Neutral.

Macro:

• Eurozone April CPI up 7% on the year, estimated 7%. April CPI up 0.6% on the month, estimated 0.7%. Eurozone core CPI up 5.6% on the year, estimated 5.6%.

• IIF indicated that global debt increased by 8.3 trillion dollars in the first three months to 304.9 trillion dollars, created the second highest number in history.

Iron Ore Key Indicators:

• Platts62 $111.00, +2.60, MTD $106.45. Eastern Chinese ports maintained active trades, however northern ports were quiet. FMG traded 188,000mt FBF at IODEX62% and a discount of 4.4%. The MACF discount narrowed from $2.6 to $2.3.

SGX Iron Ore 62% Futures& Options Open Interest (May 17th)

• Futures 92,406,600 tons(Increase 1,997,700 tons)

• Options 109,911,900 tons(Increase 2,322,500 tons)

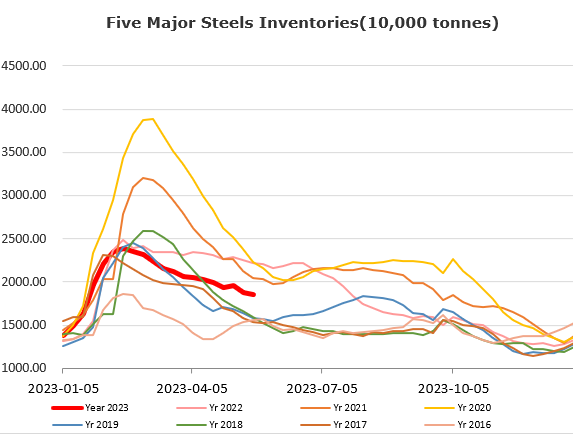

Steel Key Indicators:

• Tangshan average billet cost 3428 yuan/ton, down 66 yuan/ton. Average production realised a 32 yuan gain, reversed the loss condition last for past nine weeks.

Coal Indicators:

• The FOB Australia coking slumped during the current week because of the crowded supply. For June laycans, HCCA Prime bid at $194/mt. HCCA Branded bid at $199/mt. HCCA Peak Downs at $201/mt.