Market Verdict on Iron Ore:

• Neutral.

Macro

• China June excavators working hours at 95.2 hours, down 8.1% on the month, down 13.1% on the year. Japan June working hours at 49.3 hours, up 18.2% on the month, down 4.7% on the year. Europe June working hours at 75.6 hours, down 0.3% on the month, down 7.7% on the year. North America June working hours at 77.1 hours, up 12.4% on the month, up 5.6% on the year.

• Chinese banks started to make public announcement to officially respond to the loan suspension in some areas, indicating the banks are able to control the financial risks.

Iron Ore Key Indicators:

• Platts62 $96.60, -3.65, MTD $109.40. Resurgence of Covid-19 spread in new areas of China, plus the unexpected high temperature hit China after an extreme rainy weather, and the steel mills joint production cut, cracked down the purchase on raw materials. Steel production is expected to go lower until the resolution of oversupply. Physical traders were trying to clear cargoes on hand.

• Chinese steel mills expected that margin could recover with initiative control on production in June and July. Thus, Chinese blast furnace utilisation rate drop by more than 3% in June on the month. Seaborne float premium on PBF maintained around $0.55 to $0.65 on MOC platform over the last two months, however lack of buying interested on float basis cargoes. Newman fines saw discount first time in the year. However seaborne trades through float basis were light in general. JMBF cargoes saw ample interests and trades, discount improved from $8.7-8.9 to $8.3.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 17th)

• Futures 97,802,700 tons(Increase 4,097,400 tons)

• Options 83,863,000 tons(Increase 1,677,500 tons)

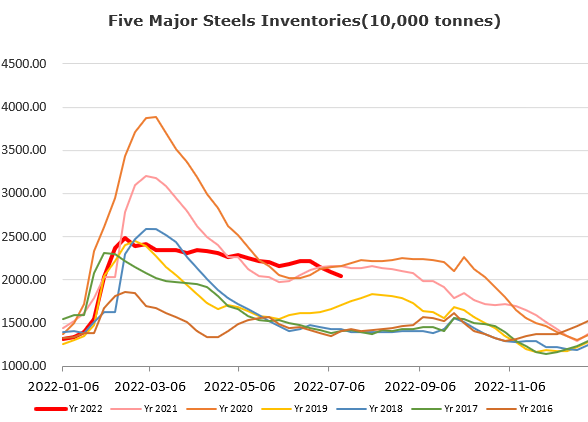

Steel Key Indicators

• China 2022 crude steel production target within 1 billion tons, a cut by 40 million tons on the year. MySteel expect the H2 2022 daily pig iron production at 2.1- 2.3 million tons.

Coal Indicators

• Australia PMV with September laycan was traded at $235 last week. Market saw ample buyers to confirm this level as the periodic bottom. The spot market support was potentially due to the contango structure of the market.