Verdict:

• Short-run Neutral.

Macro:

• FedWatch indicated that the probability of skipping interest hike in September reached as high as 98%. The 25 bps hike probability for November or December reached 60%.

Iron Ore Key Indicators:

• Platts62 $125.60, +1.65, MTD $120.66. The seaborne iron ore market saw improved popularity because of the stocking demand from China mid-autumn and national holiday. Moreover, the crude oil rebound lifted the commodity sector in general. JMBF was traded at October Index – $1.9 last Friday. MACF was traded at $121/mt. There was NHGF traded based on September Index + $1.2.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 15th)

• Futures 129,377,100 tons(Increase 2,276,500 tons)

• Options 120,171,600 tons(Increase 5,041,400 tons)

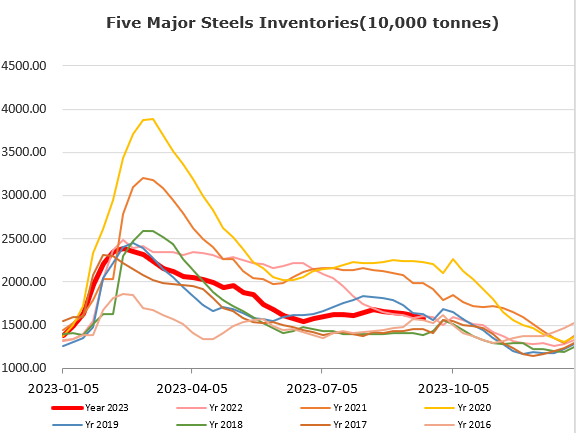

Steel Key Indicators:

• China 247 mills blast utilisation rate reached 92.65%, down 0.11% on the week, up 4.33% on the year.

• China 87 EAFs utilisation rate at 53.3%, down 0.3% on the week, up 1.46% on the year.

Coal Indicators:

• Australia FOB PMV Goonyella C was sold for 40,000mt to Indian steelmaker JSPL at $321/mt, the first time above $300 since April.