Market Verdict on Iron Ore:

• Neutral.

Macro:

• The new British Chancellor of the exchequer overturned Prime Minister Truss’s huge energy subsidy plan. Supported by the news, the British pound rose 1.54%, and the FTSE index was nearly 1% by closing.

• U.S. EIA report indicated the biggest shale oil basin production estimated increase by 50,000 barrels/day in November, reached a record high at 5.453 barrels/day.

Iron Ore Key Indicators:

• Platts62 $93.75, -2.40, MTD $95.86. The trade activity significantly improved after Chinese golden weeks. JMBF discount narrowed from $4.5 to $2.9 across holiday. PBF premium improved from 0 to $2 during same period. BRBF and Brazil mid-grade maintain popularities, however the decreased alumina premiums indicated a slight oversupply on the relevant cargoes on seaborne market. Nov- Dec 23 spread in SGX increased from $0.35 to $1.55 during the previous 5 weeks, with limited growth on the outright side. The fast expansion of the spread potentially was due to the demand market difference on early Q4 and late half of Q4 in China. The continuous production cut and inconsistant environment protection actions during Chinese national congress boosted the lump premium from $0.1 dmtu in mid-September to $0.2475 dmtu early this week. Market participants believed a follow-up growth as the physical supply was still tight at the current 2-3 weeks.

• Rio Tinto Q3 produced 84.3 million tons of iron ore, up 7% from Q2. First three quarters produciton totaled 234.7 million tons, unchanged on the year. Delivery target at 320- 335 million tons for FY2022, which was unchanged from last estimation.

• China 45 ports iron ore total arrived 21.23 million tons, down 5.41 million tons on the week. Northern six ports iron ore total arrived 9.64 million tons, down 3.016 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 17th)

• Futures 95,606,200 tons(Increase 779,900tons)

• Options 82,134,400 tons(Increase 890,000 tons)

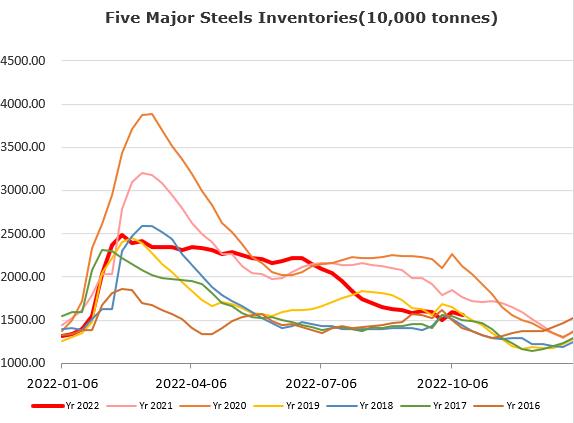

Steel Key Indicators:

• Tangshan lifted the sintering control in Tangshan from October 11-16th.

Coal Indicators:

• FOB Australia coking coal slightly upticked after a previous PLV trade reported done at $285 for 35,000mt cargoes from globalCOAL last week. The most recent source was a bid increased from $283 to $285, 75,000mt PMV. Index increase was related to the concerns on the supply tension.