Verdict:

• Short-run Neutral.

Macro:

• World Steel Association(WSA) published steel consumption report in 2023-2024, indicating the demand for 2023 estimated to increased by 1.8% at 1.8145 billion tons. The growth rate for 2024 estimated to reach 1.9%.

• China NBS: industrial utilisation rate at 75.6% in Q3, up 1.1% from Q2.

Iron Ore Key Indicators:

• Platts62 $120.15, +1.70, MTD $118.35. There were fixed trades for both MACF and NHGF yesterday.

• BHP published iron ore annual guidance following Rio Tinto, saw total WA iron ore output 282 million to 294 million tons in FY 2024. Vale maintained FY 2024 annual production target at 310-320 million tons, in line with last estimation.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 17th)

• Futures 128,711,500 tons(Increase 3,337,200 tons)

• Options 115,560,600 tons(Increase 1,225,000 tons)

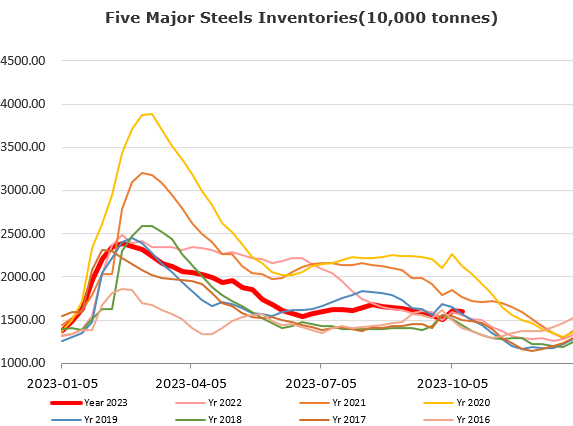

Steel Key Indicators:

• The US CRC price jumped by $40/st to $920/st ex-works supported by tight supply on steels.

Coal Indicators:

• The FOB Australia coking coal market saw 40,000 HCCA Branded coking coal offering at $367/mt, however the bids were slight low and less active. Thus, the index dropped slightly.

• China cokery plants proposal by 100-110 yuan/ton for the third rounds, yet to receive any response from steel mills.