Market Verdict on Iron Ore:

· Neutral.

Macro

· Reuters: Biden government seek the top oil producing countries to release some crude oil reserves to help decrease oil price and stimulate economy booming.

Iron Ore Key Indicators:

· Platts62 $89.95, -0.45, MTD $93.45. Iron ore seaborne market gradually return stable during the week, as several NMF trades in fixed price, the early market drop was mostly due to a general correction on commodities based on a strong U.S. dollar. Port iron ore stock growth majorly stressed down the front month contract as they were linked with delivery sentiments. However the contracts in the year 2022 were mostly connected with the CFR import cost. DCE created contango market in mid of this week. Contango market was normally a signal of periodic low historically. Spread expected to stay at current level.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 17th)

· Futures 77,184,200 tonnes(Increase 1,322,100 tonnes)

· Options 69,350,000 tonnes(Increase 1,436,000 tonnes)

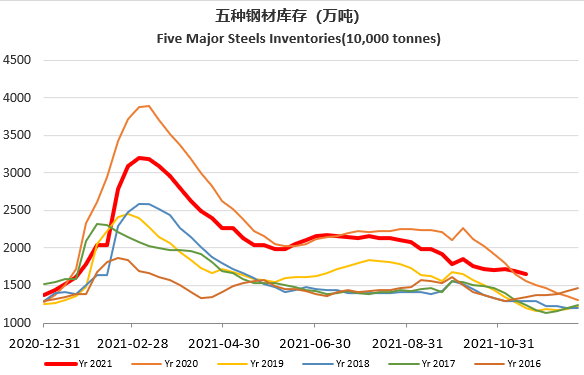

Steel Key Indicators

· China Tangshan billet cost 4295 yuan/tonne, down 625 yuan/tonne w-o-w. Steel mills margin – 115 yuan/tonne, up 355 yuan/tonne.

· MySteel Rebar Inventory: Rebar production 2.71 million tonnes, down 4.3% w-o-w. Mills inventory 2.8 million tonnes, down 2.06% w-o-w. Circulation inventory 4.74 million tonnes, down 5.7% w-o-w.

Coal Indicators

· China Coal Industry Association: January to October China top 10 coal production totaled 1.79 billion tonnes, up 113 million tonnes y-o-y. The C10 coal enterprises accounted for 54.2% of the entire coal market in China.