Verdict:

• Short-run Neutral.

Macro:

• The New York Federal governor John Williams said: “We are not really talking about cutting interest rates right now.” He said of the issue of interest rate cuts: “I just think it is too early to think about it.” U.S. interest rate futures responded with a sudden drop on interest cut probability in March from 75% to 65%.

• Since December 15th, 4 out of 5 world’s largest container-shipping companies, CMA-CGM, Hapag-Lloyd, Maersk and MSC, have suspended their services in the Red Sea, concerning the Houthi militants threats.

Iron Ore Key Indicators:

• Platts62 $135.60, +0.35, MTD $134.95. The seaborne trade was in general quiet in most of time in December compared to late November. Obviously the marginal demand has decreased. China mills were starting to hold conservative outlook for iron ore in the coming two months because of poor margin and sluggish demand market. The purchase was focus on low grade fines settled in CNY at ports.

• MySteel 45 ports iron ore inventories at 115.85 million tons, down 2.2978 million tons on the week. Daily evacuation 3.06 million tons, up 72,700 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 15th)

• Futures 120,643,400 tons(Decrease 909,300 tons)

• Options 104,658,700 tons(Increase 703,000 tons)

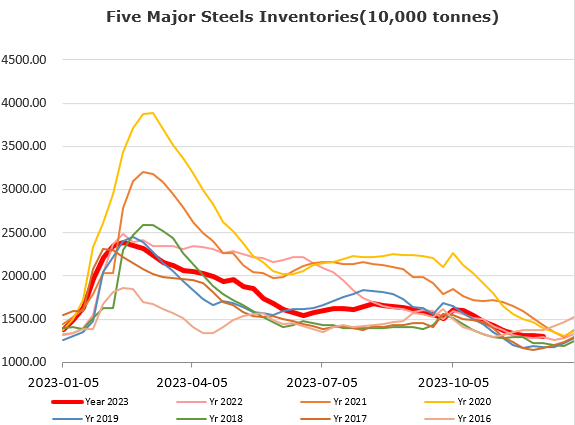

Steel Key Indicators:

• Wang Jianhua, chief steel analyst of MySteel., said that from the perspective of supply and demand, the domestic steel industry is expected to increase both supply and demand in 2024. On the supply side, crude steel production is expected to increase slightly by 1 million to 5 million tons in 2024. The demand for crude steel is expected to increase slightly by about 19 million tons year-on-year in 2024.

Coal Indicators:

• The market dampened as lower bids and concession on offers. The tradeable levels were $300-305 from mills, while $315 – 320 from traders. The December loading cargoes saw significant downward pressure.