Market Verdict on Iron Ore:

• Neutral.

Macro:

• Christine Lagarde expected the high inflation would maintain at high level in very long times, ECB potentially increase interest rate in July.

• China NBS: China exported 4.57 million tons of flat steel, up 0.7% on the year. Jan-May total exported 23.56 million tons of flat steel, up 35.1% on the year. China exported 1.04 million tons of long steel, up 24.7% on the year. Jan-May total exported 4.58 million tons of long steel, up 74.1% on the year.

Iron Ore Key Indicators:

• Platts62 $115.50, +0.10, MTD $112.36. Although PBF witnessed a fast growth during the past two weeks, BHP sold JMBF based on July Index average and a discount of $5.3, last week discount was $4.2. Considering the cost-efficiency, mid-grades are still the best options for mills. However some traders indicated that the high grade and low grade blending are growing on the cost efficiency as well.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 16th)

• Futures 97,093,200 tons(Increase 950,100 tons)

• Options 106,818,100 tons(Increase 915,000 tons)

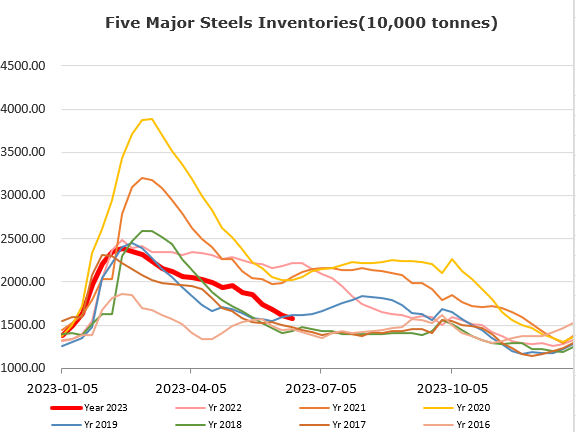

Steel Key Indicators:

• Arcelor Mittal increased HRC at Alabama by $50/st to $950/st.

Coal Indicators:

• A major transportation accident occurred in a coal mine under China National Coal Group. Shanxi Province started safety inspection during June 19- July 16th.

• The Indian mills were actively sourcing June and July coking coals.