Verdict:

• Short-run Neutral.

Macro:

• US Treasury Secretary Janet Yellen said that it’s premature to judge the impact of UAW strike, and sought for a “win-win” deal.

• ECB governors indicated that the Thursday interest hike potentially become the last hike in the year.

Iron Ore Key Indicators:

• Platts62 $124.45, -1.15, MTD $121.00. The seaborne iron ore market saw improved popularity because of the stocking demand from China mid-autumn and national holiday. BRBF was traded at $1.56 premium based on October Index. However some traders and mills believed that the index was less sustainable near six-month high.

• China 45 ports iron ore arrivals at 22 million tons, down 5.028 million tons on the week. Northern six ports arrivals at 9.871 million tons, down 2.554 million tons on the week.

• China produced 86.33 million tons of iron ore in August, up 1.3% on the year. China produced 659.169 million tons of iron ore from January to August, up 7% on the year.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 18th)

• Futures 132,438,800 tons(Increase 3,061,700 tons)

• Options 132,130,500 tons(Increase 11,958,900 tons)

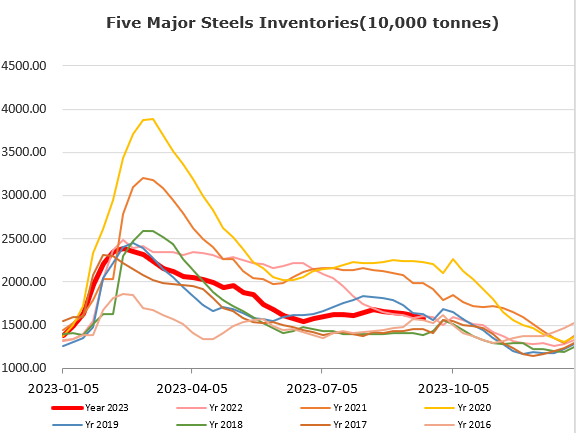

Steel Key Indicators:

• China 87 EAFs utilisation rate at 53.3%, down 0.3% on the week, up 1.46% on the year.

Coal Indicators:

• BHP yet to respond the detail impact on the truck accident last week and the resumption date.

• China cokery plants coke price proposed to increase by 100-110 yuan/ton, yet to receive any response from steel mills.