Verdict:

• Short-run Neutral.

Macro:

• The US Federal Governor Mary Daly indicated that a rate cut in 2024 would be appropriate. A total three cut in 2024 should be necessary.

• European Central Bank Council member said that the market expectations for an interest rate cut in next March or April are too early. The bank won’t reaccess the policy until next spring.

Iron Ore Key Indicators:

• Platts62 $133.95, -1.65, MTD $134.87. Vale sold 170kt BRBF before the MOC closed yesterday at $133.75/mt. The landing margins were thin, while mills production margin were majorly around breakeven. The restock was more relying on portside stocks.

• China 45 ports iron ore arrivals at 25.83 million tons, up 1.297 million tonnes on the week. Australia and Brazil delivered 19 million tons of iron ore, down 1.1 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 18th)

• Futures 120,777,400 tons(Increase 134,000 tons)

• Options 104,703,700 tons(Increase 45,000 tons)

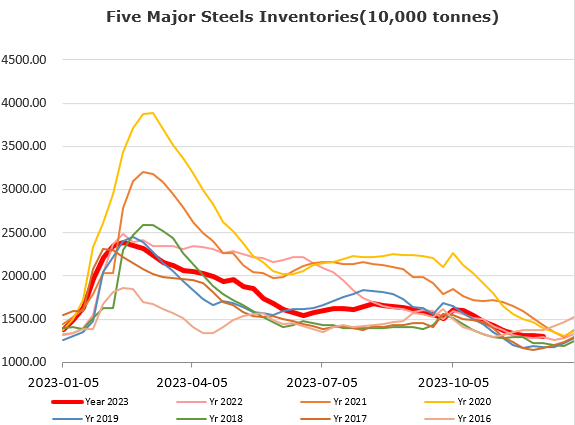

Steel Key Indicators:

• China total exported 54.46 million tons of flat steels from January to November, up 39.2% on the year. China total exported 10.07 million tons of long steels, up 46% on the year.

Coal Indicators:

• On December 17th, a transportation accident occurred in a coal mine in Changzhi County, China. According to research, the group’s other coal mines are in normal production except for the accident mine, which has been suspended. MySteel researched the accident mine has a 7.5 million tons of coal capacity annually.