Market Verdict on Iron Ore:

· Iron ore short-run neutral.

Macro

· The Ministry of industry and information technology will cooperate with relevant departments to ensure the supply and price stability of bulk commodities, coordinate to deal with the risk of market price fluctuation, and resolutely crack down on hoarding, malicious speculation, and bid up prices.

· China Iron&Steel Association completed the first draft of its roadmap toward carbon neutrality.

Iron Ore Key Indicators:

· Platts 62%: $221.10 (-1.20) MTD $219.55

· MySteel estimated H2 2021 China crude steel production decrease 10.6% y-o-y(59.46 million tonnes), equaled a daily reduction of 12.9% on daily production compared to June.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 16th)

· Futures 80,891,600 tonnes(Increase 1,564,600 tonnes)

· Options 80,387,900 tonnes(Increase 430,000tonnes)

Steel Key Indicators

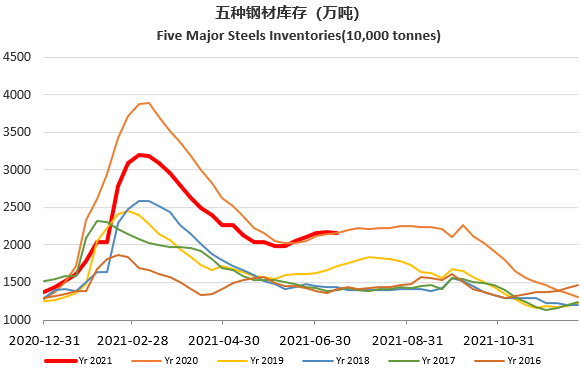

· Steelbank construction steels inventory 7.597 million tonnes, up 2.36% w-o-w. HRC inventories 2.651 million tonnes, up 4.49% w-o-w.

· China YuanNan Province started a restriction on electricity usage. Six blast furnace and one EAF were impacted. The reduction on production reached 30-40%.

· China Henan province sent a urgent notice of high temperature, most of construction steel rolling were suspended, utilisation rate decrease significantly to 22.85%.

· MySteel Rebar Inventory: Rebar production 3.55 million tonnes, up 2.96% w-o-w. Mills inventory 3.25 million tonnes, down 5.27% w-o-w. Circulation inventory 8.27 milliontonnes, up 1.75% w-o-w.

· China 237 enterprises totaled 650 million tonnes of crude steel capacity completed a low carbon emission upgrade, 61% of total crude steel capacity.