Market Verdict on Iron Ore:

· Neutral to bullish.

Macro

· OECD change the global economy growth rate prediction from 5.7% to 5.6%. In addition, OECD also decrease the growth outlook in U.S. and Euro zone this year and next year.

· Fed Beige Book: in October and early November, economic activity in most fed jurisdictions increased at a moderate economy growth rate. Some regions noted that despite strong demand, growth was limited by supply chain disruptions and labor shortages. The strong demand for raw materials, logistics challenges and tight labor market, input costs have increased significantly.

Iron Ore Key Indicators:

· Platts 62%: $101.40 (+1.45), MTD 101.40. Seaborne market saw very active trading, 6 laycans of MACF with same discount at $10.2 based on Platts62% January were traded during the current two weeks. China northern ports iron ore picked up at an average of 10-15 yuan/ton daily during this week. SGX Dec-Jan spread become negative since December production restriction was harsh, however January production was not strictly controlled.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 24th)

· Futures 73,711,800 tonnes(Increase 596,700 tonnes)

· Options 52,426,000 tonnes(Increase 380,000 tonnes)

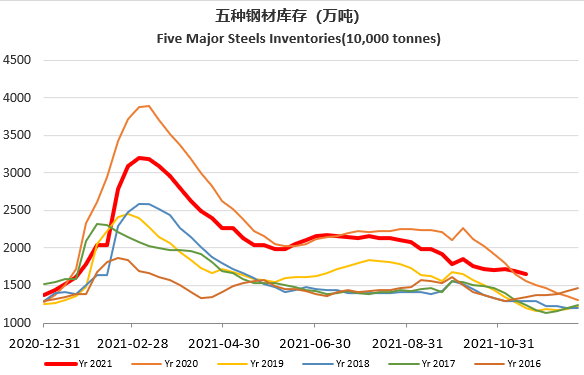

Steel Key Indicators

· Tangshan average steel mills billet cost 3942 yuan/tonne, down 106 yuan/tonne w-o-w. Steel profit margin 348 yuan/tonne, up 96 yuan/tonne w-o-w.

· MySteel Rebar: production 2.77 million tonnes, up 1.85% w-o-w. Mills inventory 2.29 million tonnes, down 13.7% w-o-w. Circulation inventory 4.14 million tonnes, down 6.57% w-o-w.

Coal Indicators

· China Mongolia port decreased the clearance of coal export trucks from 600 to 100 on daily basis to resist the spread of new round of pandemic.