Verdict:

• Short-run Neutral.

Macro:

• The United Nations has released the “2024 World Economic Situation and Outlook” report, which shows that compared to January 2024, the United Nations is more optimistic about the world economic outlook and has raised its global economic growth forecast for this year from 2.4% at the beginning of the year to 2.7%.

Iron Ore Key Indicators:

• Platts62 $118.00, +1.10, MTD $116.89. The recent rebound on ferrous was contributed by the housing stimulus in China and risk off sentiment on commodity market. As the pass of the peak construction season, it would be hard to see big marginal improvements on ferrous consumption in June and July. Thus, iron ore rebound looked very humble compared to other metals. Tangshan concentrates were found to be better cost-efficiency to many seaborne premium products. However, the fast depleting on IOCJ supported the high grade price. In general, MB65- P62 are expected to widen in the recent weeks.

SGX Iron Ore 62% Futures& Options Open Interest (May 17th)

• Futures 115,201,700 tons(Increase 779,500 tons)

• Options 140,228,200 tons(Increase 1,812,000 tons)

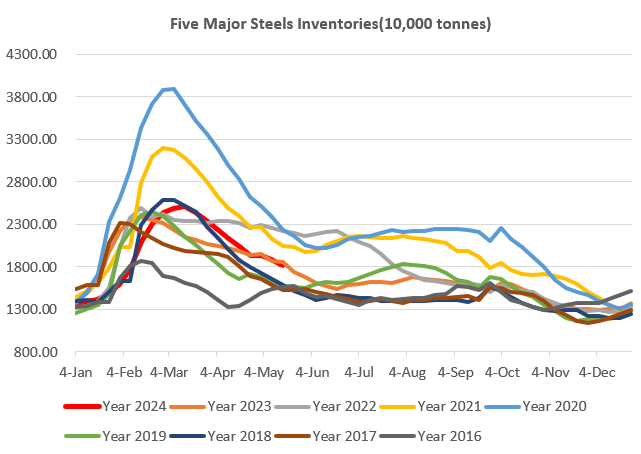

Steel Key Indicators:

• China 87 independent EAFs average operation rate at 68.53%, up 4.35% on the week, up 3.21% on the year.

• China 247 BF average operation area at 81.5%, flat from last week, down 0.86% on the year.

Coal Indicators:

• The Australia coking coal market saw wide bid ask spread at %39 for PMV, since both buyers and sellers were entering watch and see mode to wait for the directions on derivatives market.