Market Verdict on Iron Ore:

• Bearish.

Macro

• U.S. Energy Department indicated that U.S. appeal to increase oil production. A tanker carrying 650,000 barrels of Venezuelan crude oil destined Europe . This is the first time that Venezuela, under US sanctions, has exported crude oil to Europe in the past two years.

• U.S. President Joseph Biden said that a decision is being made on relaxing tariffs on China. The Biden administration is studying the abolition of some tariffs imposed on Chinese goods by former president Donald Trump. Recently, Biden has faced increasing domestic pressure to control the country’s highest inflation rate in 40 years.

Iron Ore Key Indicators:

• Platts62 $122.15, -7.35, MTD $138.73. Mainstream iron ores didn’t saw any active buyers during this week although improving import margins. The steel margin was suffering a loss. As expected, iron ore eroded steel mills margin and made an overdraft of growth in advance. Thus, mills are currently utilising premier coking coals to increase reducibility of low grade iron ore, which could reduce cost comprehensively. The 45% tax increase on Indian pellets and previous Ukraine supply disruption to Asian countries led to a global seaborne pellets shortage, which yet to see any alternative.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 17th)

• Futures 84,936,800 tons(Increase 599,900 tons)

• Options 81,968,700 tons(Increase 1,198,200 tons)

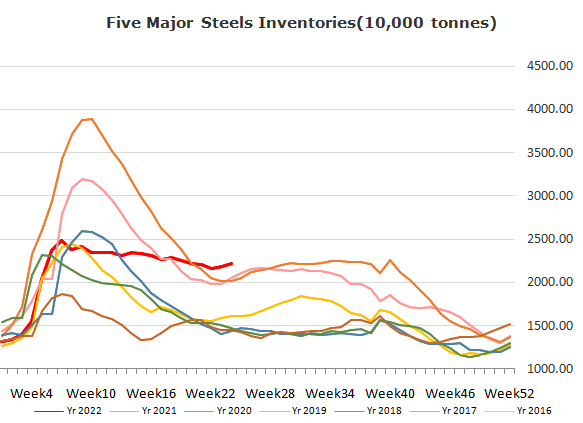

Steel Key Indicators

• 40 independent EAFs construction steel average cost 4798 yuan/ton, down 95 yuan/ton w-o-w. Average loss 143 yuan/ton w-o-w.

Coal Indicators

• After Australia FOB market sharp falling over previous few weeks, buying interests emerged in the range $375- 380. In addition, the demand of India and south-eastern countries recovered according to market participants. Steel mills in northern China decreased the bids on physical price by 300 yuan.